III. Economic Analysis of Pure Competition

A. Competition is

efficient.

1.

Price settles where long-run ATC is at its lowest point indicating goods are

produced efficiently.

2.

P = MR = MC indicating that resources are allocated efficiently as

$'s spent by consumers (P) = the

$'s received by producers (MR) = the

$ cost of producers (MC) and

economic profit is zero.

B. Shortcomings

1.

Spillover costs (pollution) and benefits (education) aren't properly measured

resulting in

goods being over and

under produced.

a. Government intervention was needed to lower automobile pollution.

b. Governments supports education with grants and inexpensive loan problems

to students and colleges.

2.

Monopoly power develops to negate Adam Smith's "invisible hand" of

competition which is required to

assure that the purely

competitive adjustment occurs.

3. Eliminating economic

profit makes it difficult for competitive firms to afford expensive R & D technology.

4.

Economic Growth Volatility |

Application

Question

Is Purely Competitive Adjustment Causing a New Normal Or

Is

The New Normal Not New or Normal?

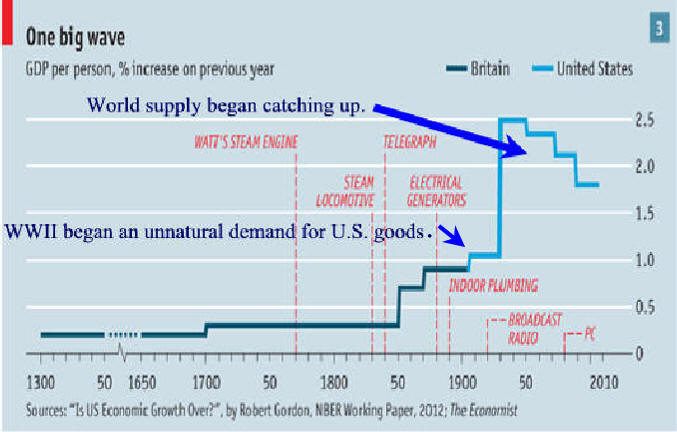

Beginning with economic expansion caused by WWII, demand for U.S.

manufactured goods increased dramatically. As a result, demand

increase from D to D.' Profits maximization resulted. Thanks in part to

Unions, these manufactures shared their excess profits with unionized

workers and wages increases spilled over to many nonunion workers. It took

Germany, England and Japan many years to repair war damaged manufacturers

and bring an end to U.S. manufacturer's monopoly power.

Serious competition from

foreign manufacturers beginning with automobiles and steel increased

supply causing Rust Belt Industries to lose their pricing power. This eliminated

excess profits. Some industries incurred a loss as supply increased too much.

Wage give backs began and many workers found themselves with stagnating wages.

Companies used technology and outsourcing to be more competitive and maintain

profit but this put pressure on wages.

This also happened in

the finance industry with competition coming from foreign banking and cheap

Internet trading. Their attempt to increase D for their services with exotic

products like derivatives has not worked out well as of 07/01/10.

The bottom line is the

standard of living enjoyed by U.S. citizens, their micro-lives, will grow more

slowly as it is forced to share the wealth with people from around the world.

We may even have to give some back because of our energy dependence and

recent decadence though increased production of energy with shale has lessened

lessen this dependency. But we will still enjoy the highest standard of

living in the industrialized world. |

IV. Competitive Supply

A. The firm's MC curve is its short-run supply curve.

B. Industry supply is the horizontal summation of the firm's supply

curves.

C.

Economics: Long

Run Supply - Cliffs Notes

analyzes the affect of long term supply on efficiency.

Unit V Review

requires many independent resource suppliers competing with virtually

identical factors

V. Other theories of the

Competitive Model

(from Wiki requires calculus)

A.

Bertrand competition

B.

Cournot competition

requires calculus.

VI. U.S.

Competitiveness Declines

Econintersect: The U.S. slipped

to seventh place in the ranking of economic competitiveness in the 2012.

source the WEF (World Economic Forum).

Last year the U.S. ranked fifth.

The current result marked the fourth year

of decline for the country that used to rule the competitiveness roost.

More

from econintersect.com.

IMD Disagrees with its 2012 World Competitiveness Rankings

Editor's comment

on free trade

Free trade increase supply

which forces price down resulting in

some combination of lower profit

or lower cost.

Owners and managers&inspire good at maintaining profit and will try to lower the cost of

materials,

labor or overhead. Workers often bear the brunt of this

process.

The effect of Covid on

Globalization is dramatically changing trade

|

Question Is Recovery from the Great

Recession indicating

A Few US Company Still Dominate,

Many Do Not

Technology will continue to make

our macro-lives better,

especially now that the Asians are contributing with

their

R&D investments and collaborative competition in science

helped by the

Internet has accelerate scientific advancement.

Plus gains from science

are often cumulative and while not a

straight line upward they eventually make

our macro lives better.

Think childhood diseases being cured and smart phones.

Plus its always good remember the best things in life will continue

to be

free and having enough money is a function of demand,

not supply. 08/12/11

updated 8/24/15

See

Promises, promises (3 graphs)

|

See

US Economic Normality 1945-2015

page 2,

World Changed and Good Jobs Disappeared

20th Century U.S. Decade Ranking

VII. Readings

A. For a conservative view of competition

Read

Pure and Perfect"

Competition? from

Capitalism Magazine By What Standard?

Part 5 in a Series of articles on Capitalism, Free-competition,

Antitrust, and Microsoft,

By Richard M. Salsman

B. Present

Day Application of the Purely Competitive Adjustment

C.

Collaboration

Competition is the New Competition

|

Citizen Well-Being

is Important and Continually Grows.

1) Our society's stability has

consistently increased US productivity

which is key to individual well-being. Think how the

public safety net

has increased since the 1930's and the success of the

federal

children's bureau. Think

economic distress in Russia, Europe,

and even Japan.

2) Scientific achievements have

continuously added to citizen

well-being. Think

public health, smart phones with loads of

free stuff not part of GDP or wages, streaming audio-

video, Gillette Stadium ... See

Health Problems Solved

3) Personal Income which is a function of nature and

Think nurture has

increased continuously if not always rapidly.

Russia, China,

and Europe's really slow recovery from the Great

Recession.

Source

Economic Wellbeing

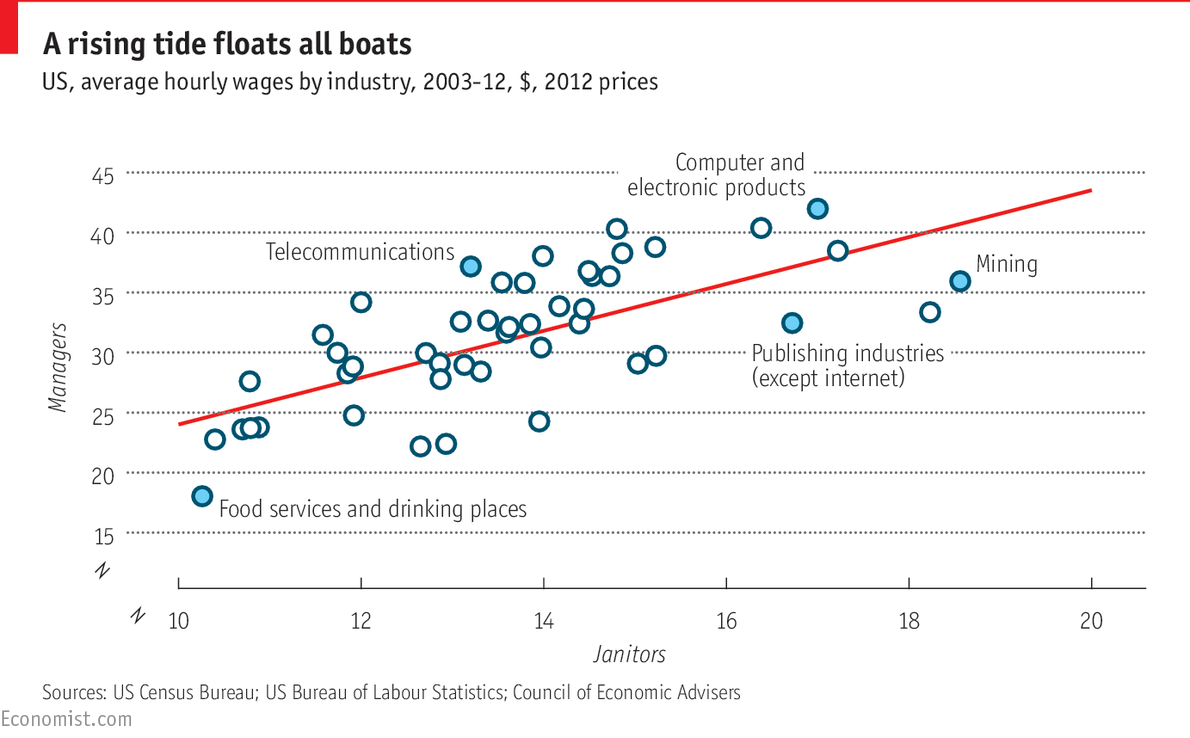

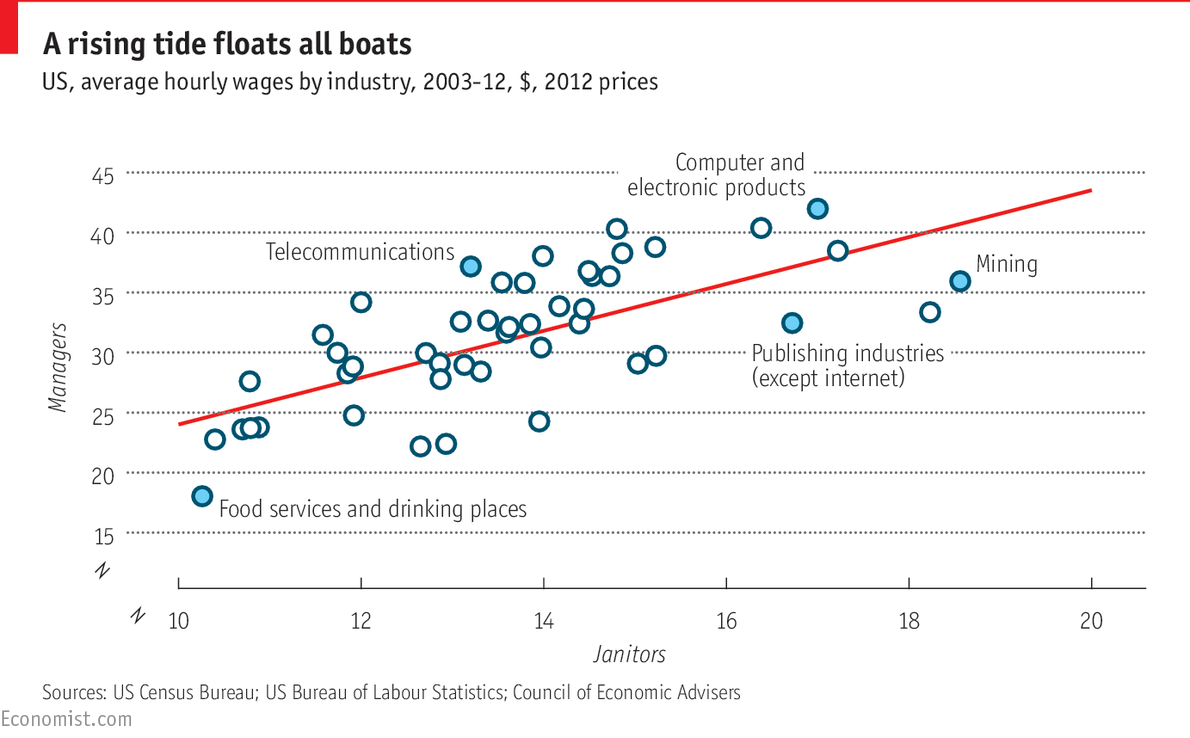

Some Successful

Companies Pay Everyone Well

from

economist.com 01/12/1 and 10/1/16 |