|

Lecture Notes

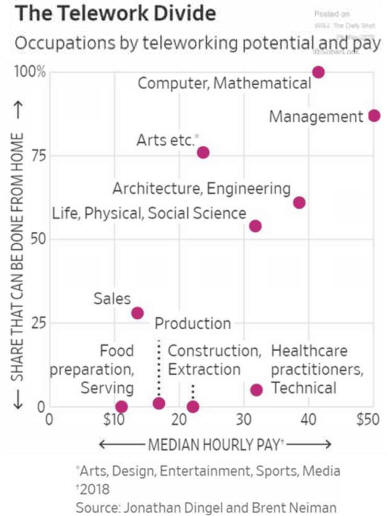

VIII. Market

Income

Does Not Measure of Well-being.

A. Many goods, especially since the digital

revolution,

provide more satisfaction than their cost indicates.

Income is thus understated.

Much of the value

provided by a smart phone was not

available 25 years ago and those that were each cost

thousand's of dollars. Movies that do not need

developing that will send anywhere in the

world didn't exist.

B. Government makes our lives better in

ways not measured

by market income. Curing childhood

disease and limiting

pollution are

just two economist's unmeasured item

C. Successful government fosters peace

allowing the

elimination of a peacetime draft.

D. Interesting Opinions

1. Conservative

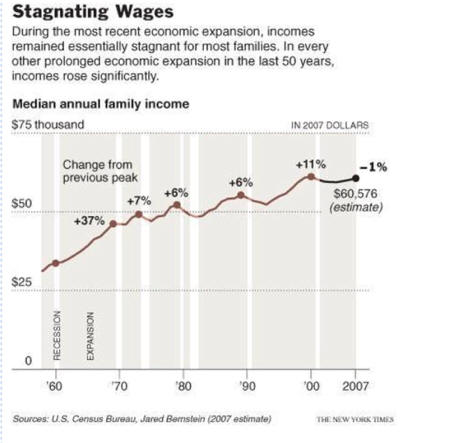

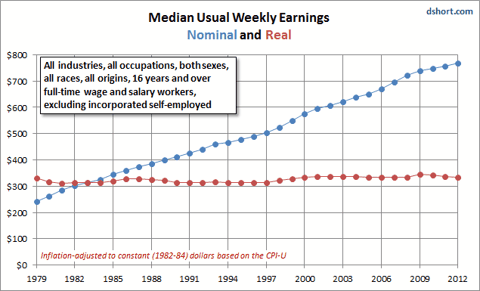

Is "Income Stagnation" a Myth?

2. Liberal View

Sad Story of Wages in Americans

3.

The Daily Show on Class Warfare

E. Child Safety is Not Measured but it increase of

well-being is

immeasurable. NYTimes.com

1. Physical abuse dropped 55% from 1992-2011

while

sexual abuse

dropped 64%.

2. Abduction by strangers dropped 52% from 1997

-2012.

F.

Social Progress Index ranks large industrialized

nations as good but below smaller rural more

northern nations.

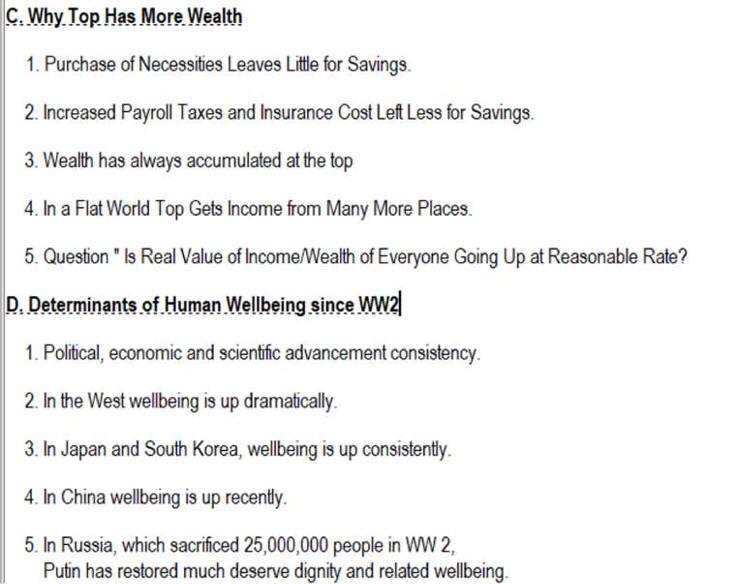

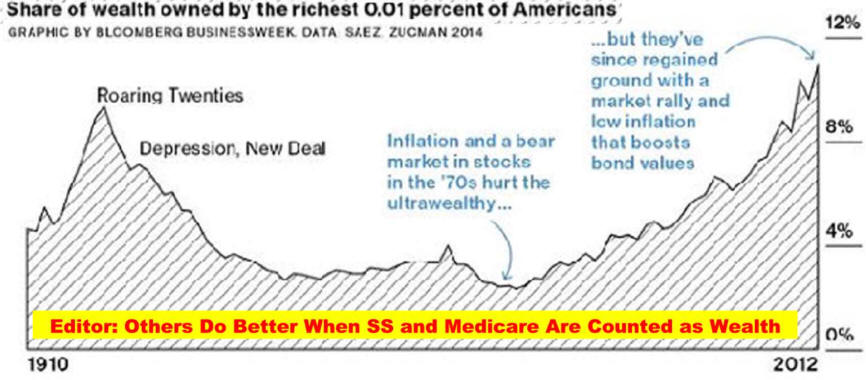

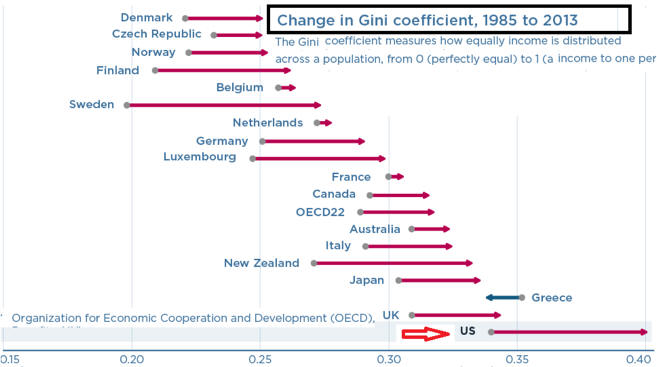

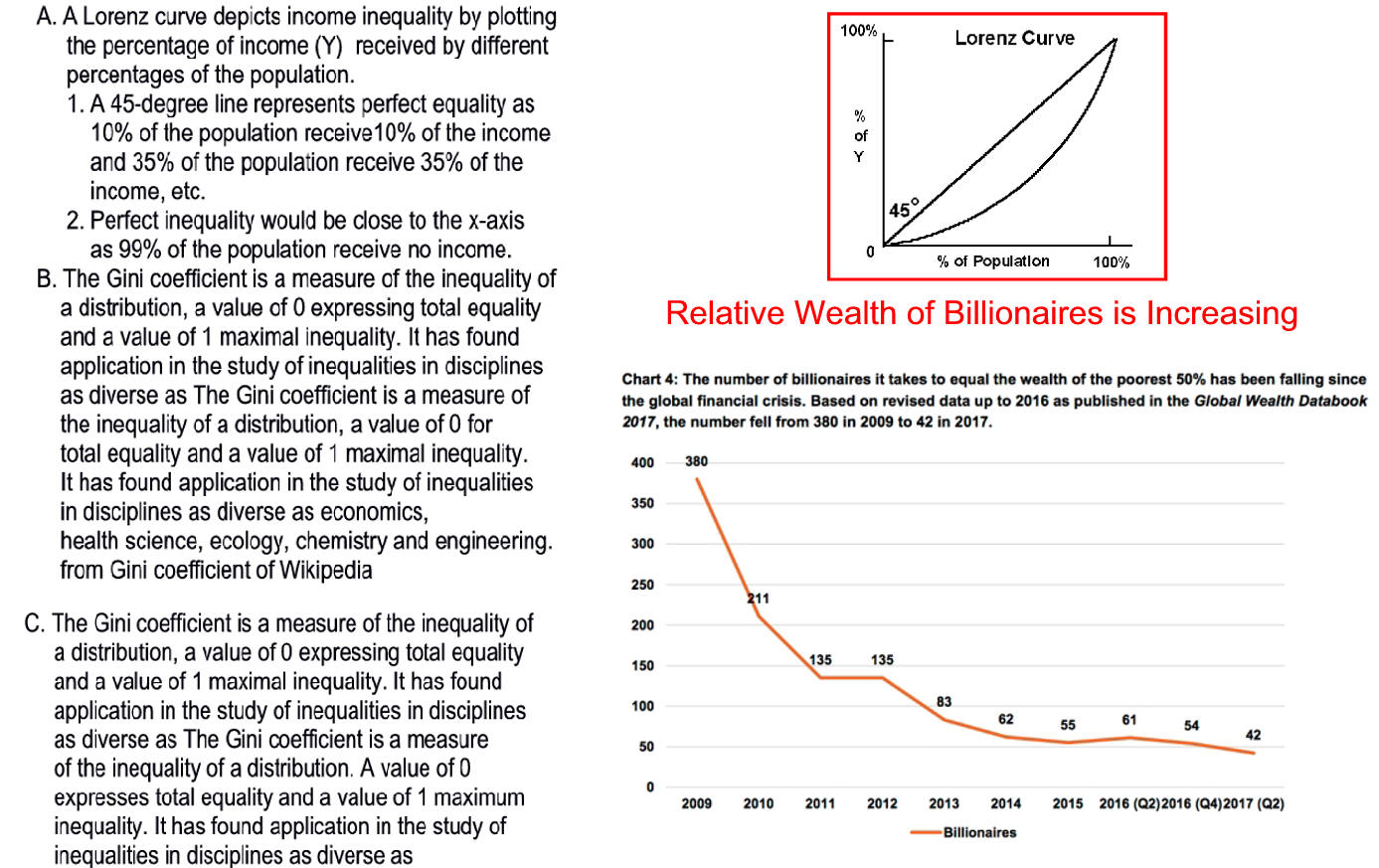

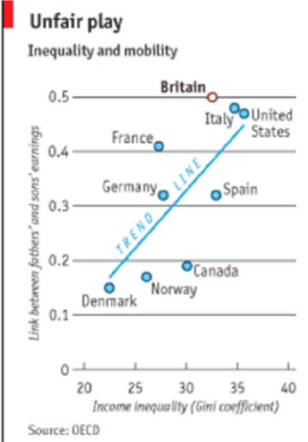

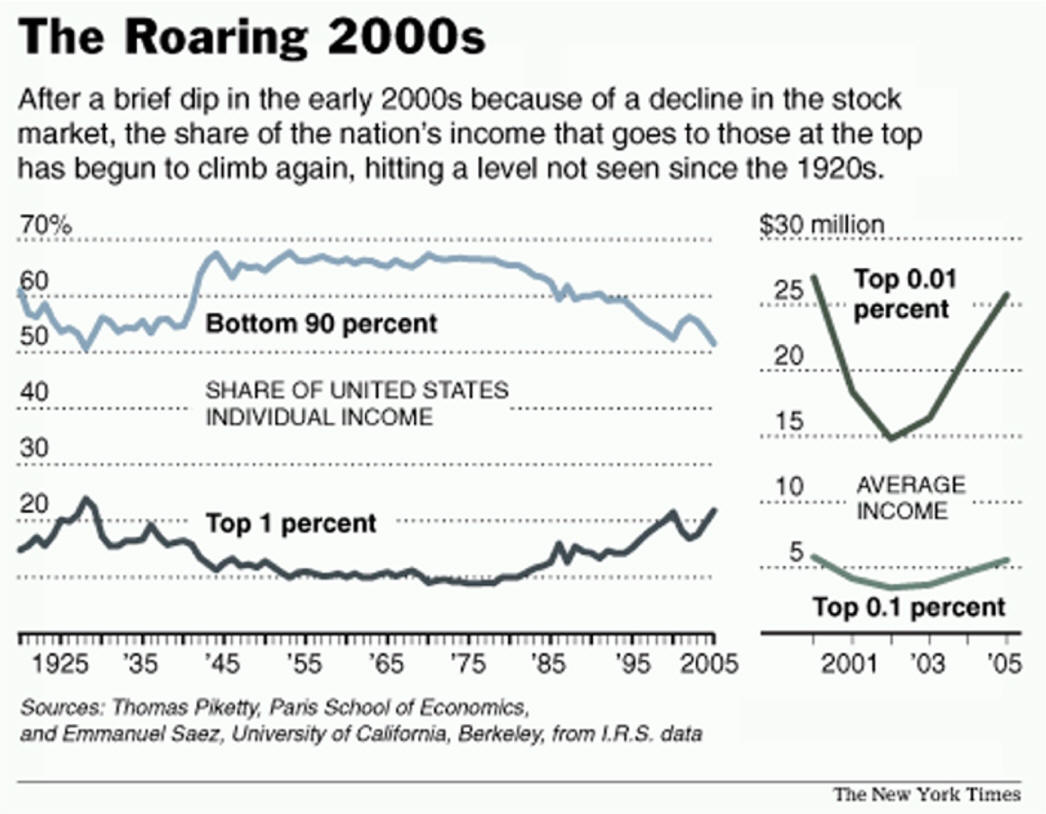

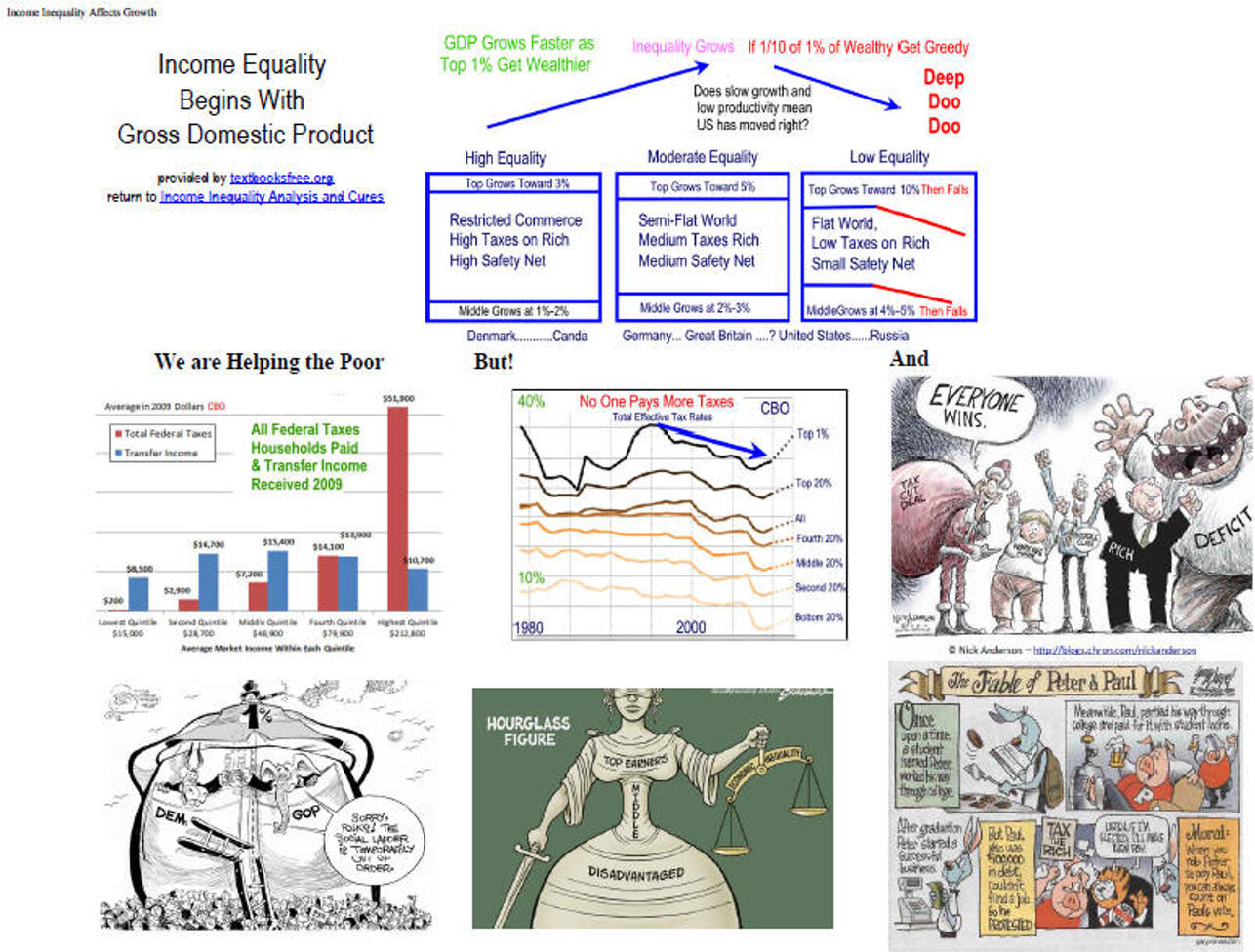

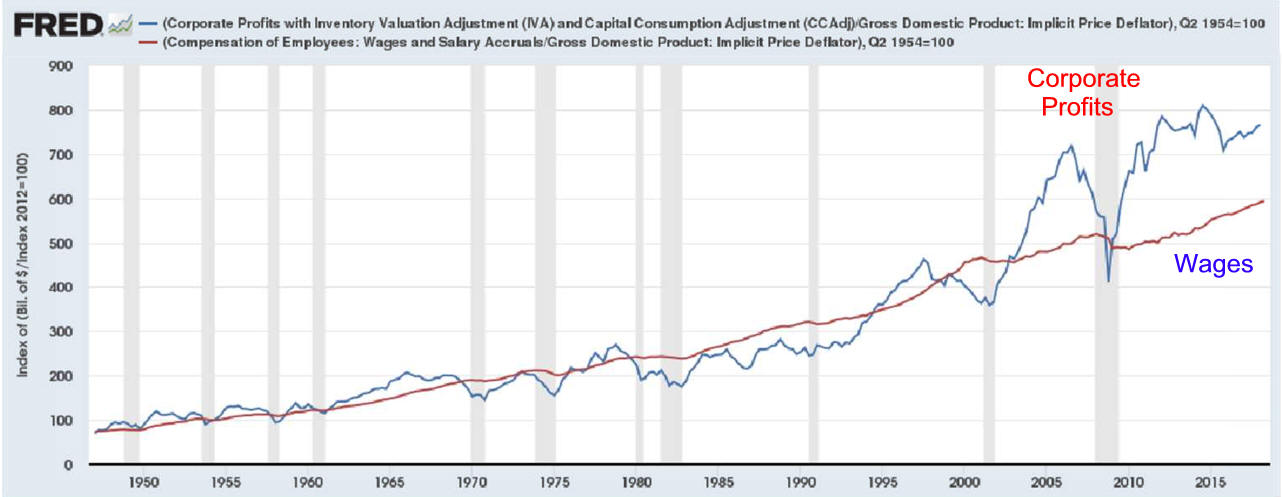

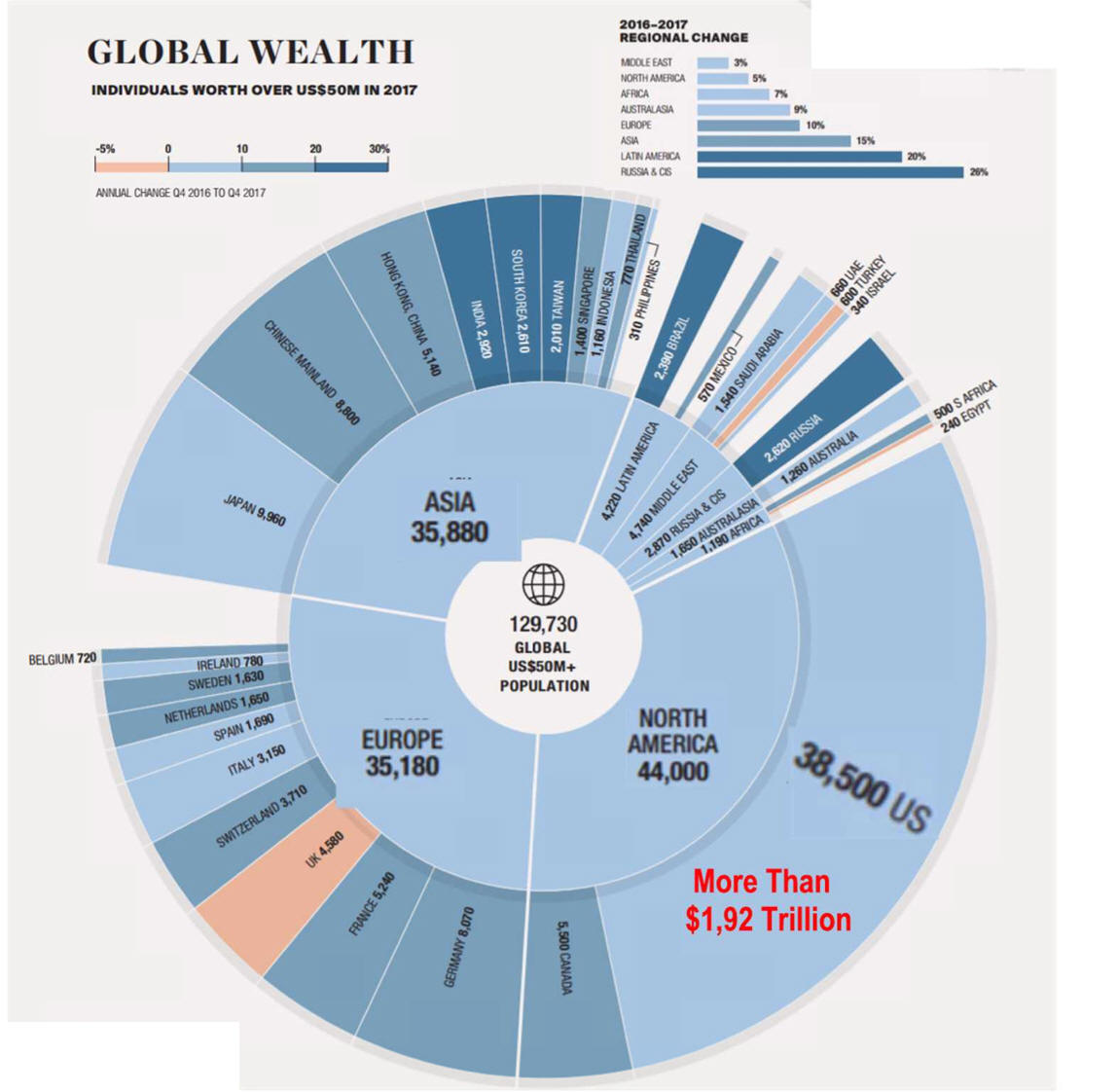

X.

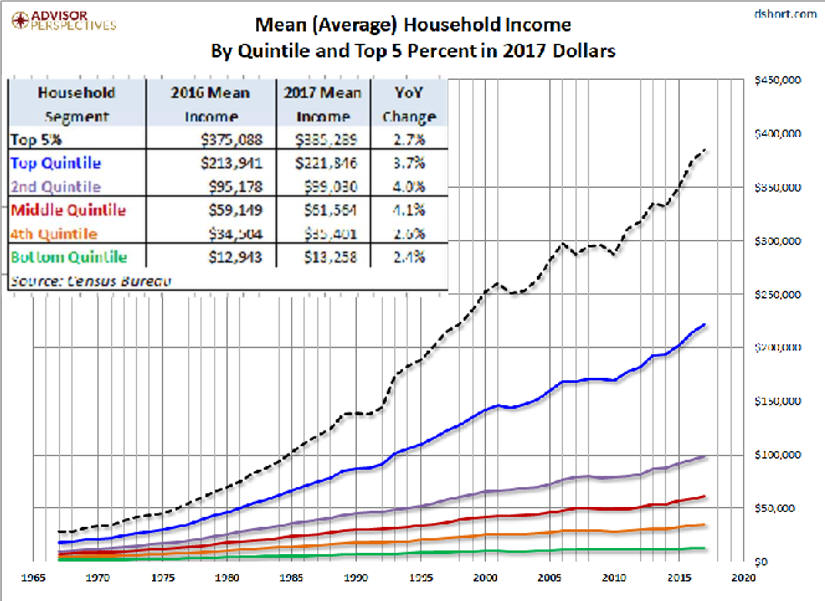

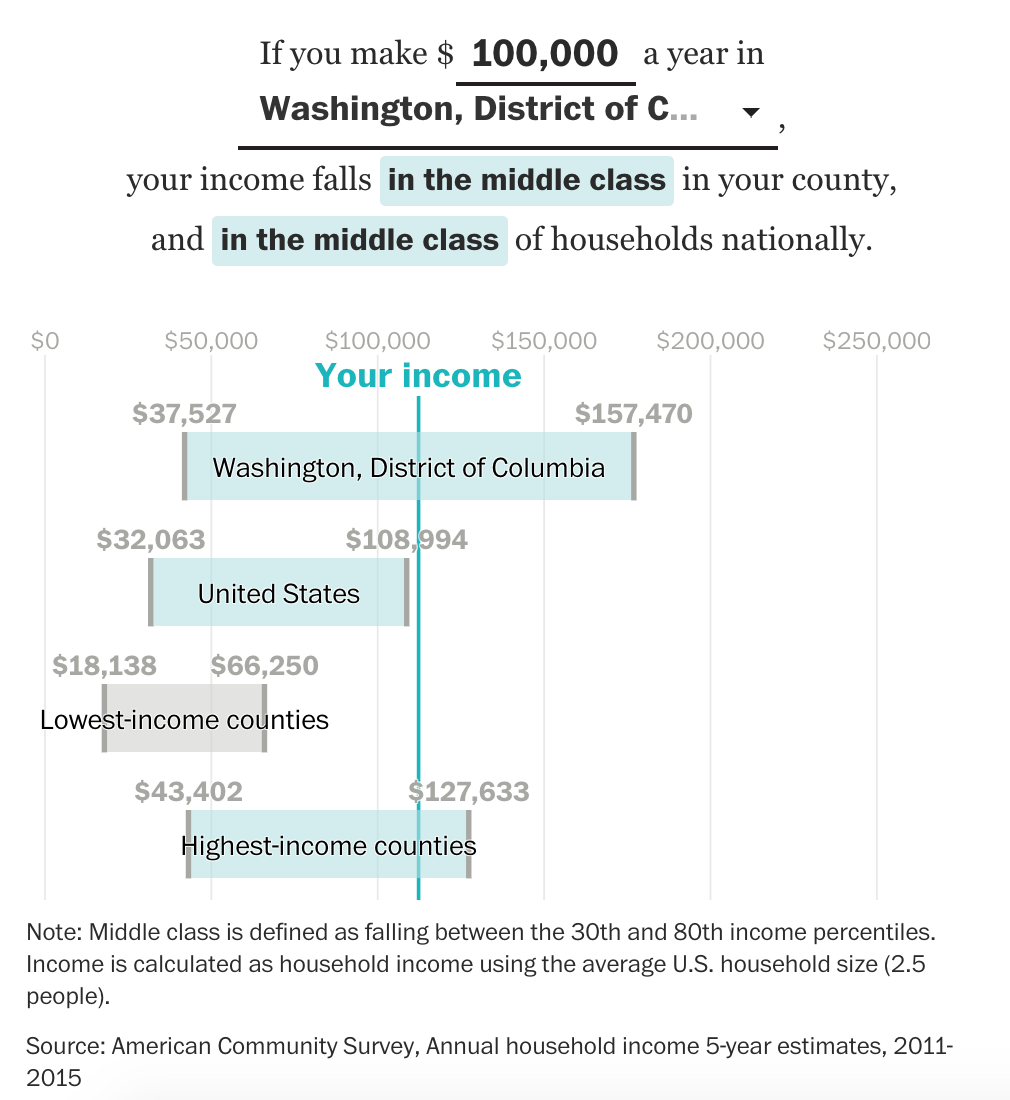

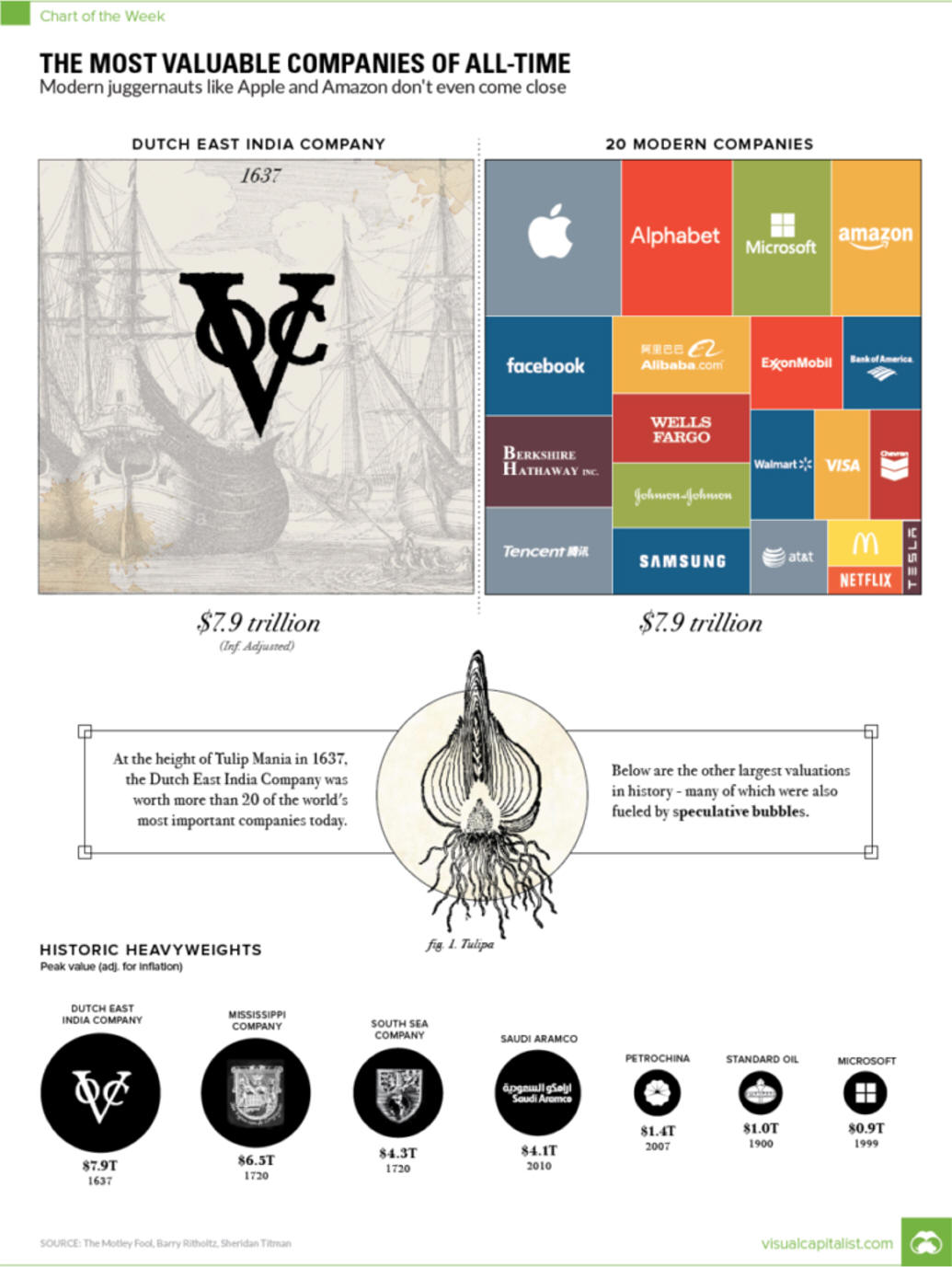

Income Inequality

Affects Growth

A. At some point,

Business

1. Takes Too Much

2. Growth Slows

3. Politics becomes unstable

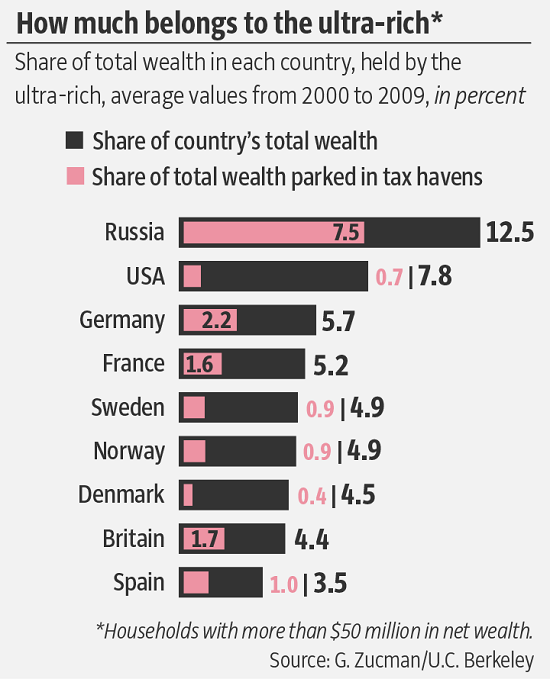

B. Would a

Wealth

Tax slow growth?

Conservatives Say Yes

Liberals don't ask the

question. |

Supplemental

Political Economy

Stuff

Additional Information

1.

Income - Home

for census bureau data and reports.

2.

Millions live in extreme poverty here is how they get by

3.

Fight

Poverty in the U.S.

from save

the children

4.

The Bell Curve and Social Stability:

Shrink Wrapped Blog,

A Psychoanalyst Attempts to

Understand Our World

5. The Capitalism They Hate by Anthony

de Jasay

A. Part I

The Inequality Machine

B. Part II

Indecent Earnings

6.

Coming

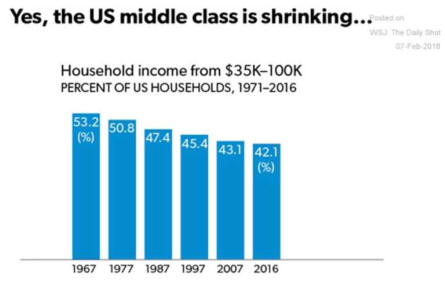

Collapse of Middle Class - E. Warren UC Berkeley

7.

Americas-class-system-across-life-cycle has lots of data. 3/25/14

8.

Income Inequality: A Question With No Easy Answer

9.

Second opinion of economic well-being of America's middle class.

Burkhauser, Jeff Larrimore, and Kosali I.

Simon, Nat. Tax Journal

This should be compared to the very poor

"analysis" discussed

yesterday (Manhattan Institute:

The Myth of Increasing Income Inequality by Diana Furchtgott-Roth).

In this

case a careful analysis reveals that such things as changes in

tax codes,

in-kind benefits (such as employer-provided health

insurance) and inclusion of

household make-up show less of an income

disadvantage for the middle class over

the last 30 years than simply

looking at pre-tax tax unit analysis. But there

still is a degradation,

not just as much. from

econintersection

See

Income Inequality Analysis and Cures

Election Issues 2016

Inequality and Economic Policy

Conversation with Mark Blyth: Economics and Social Justice |

|

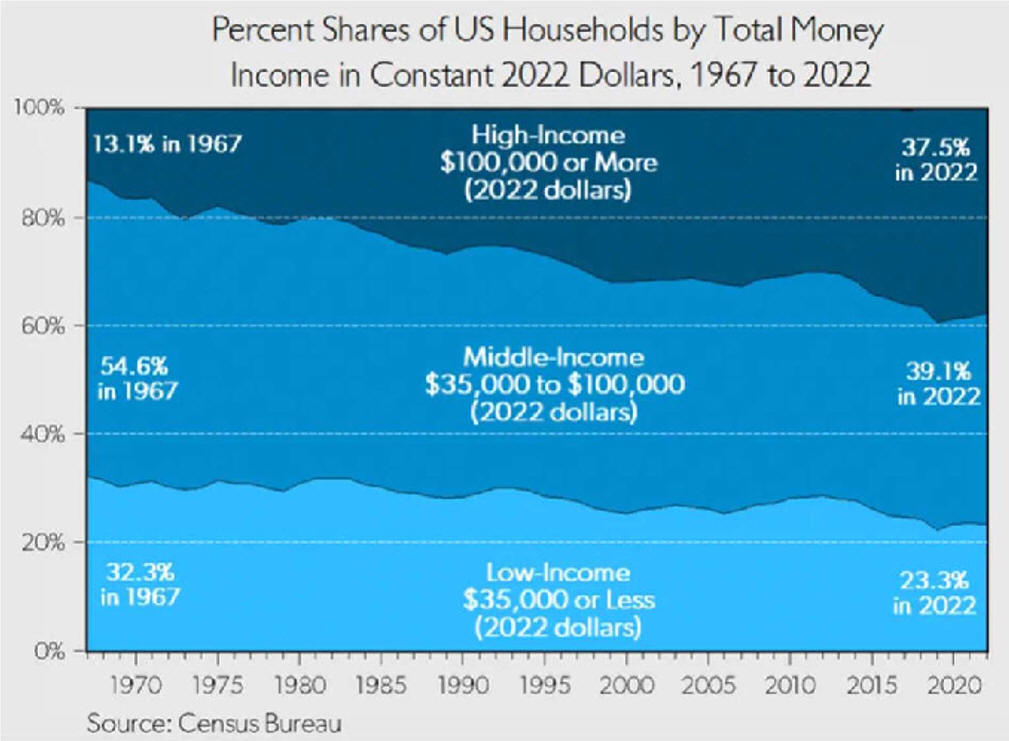

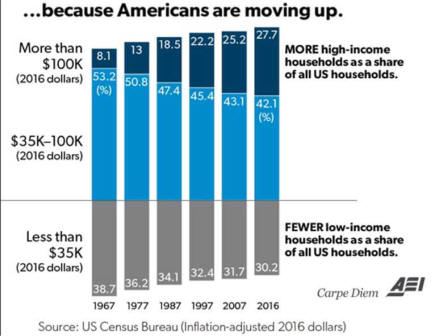

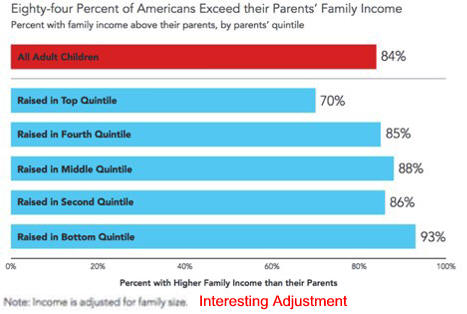

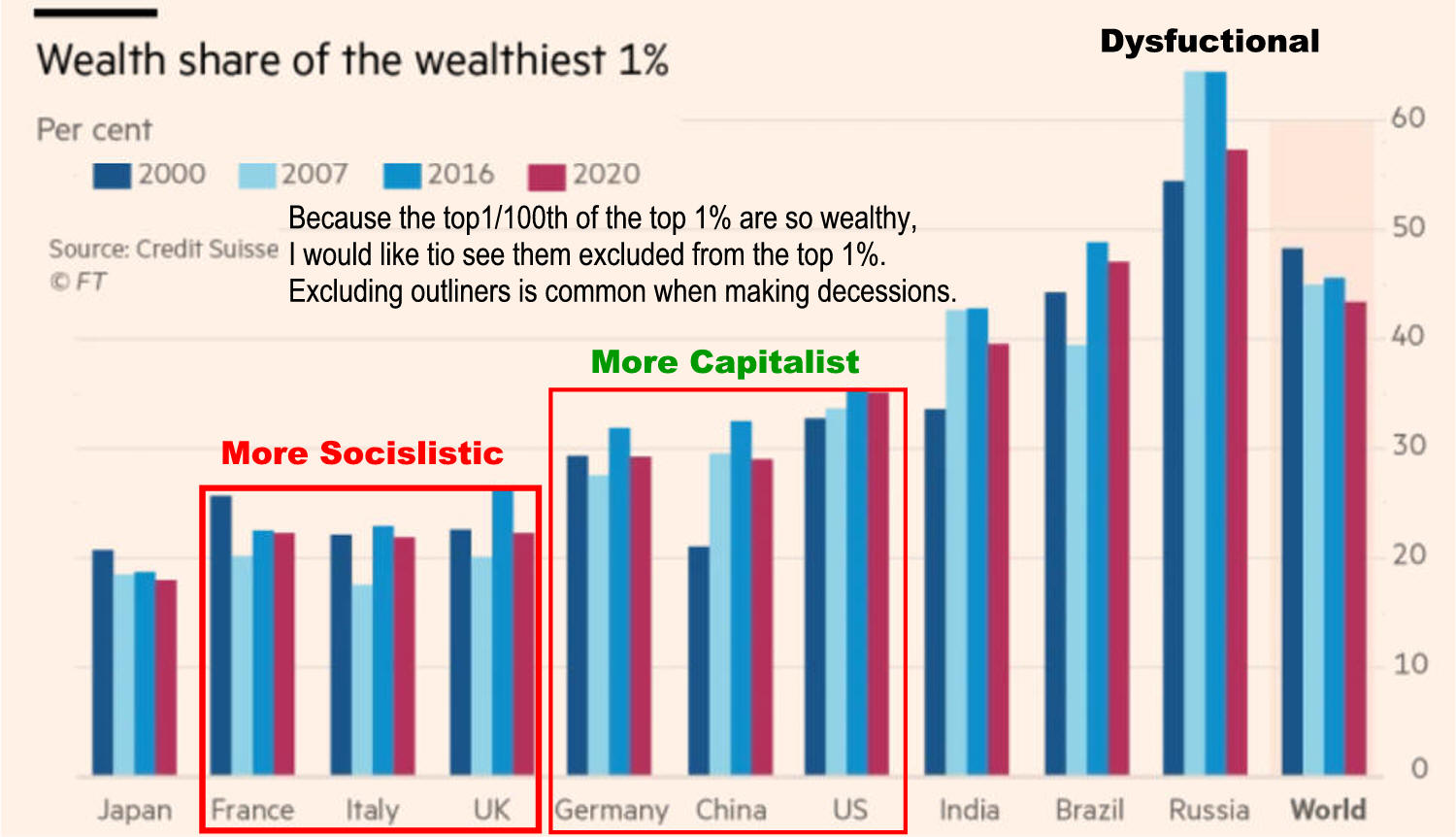

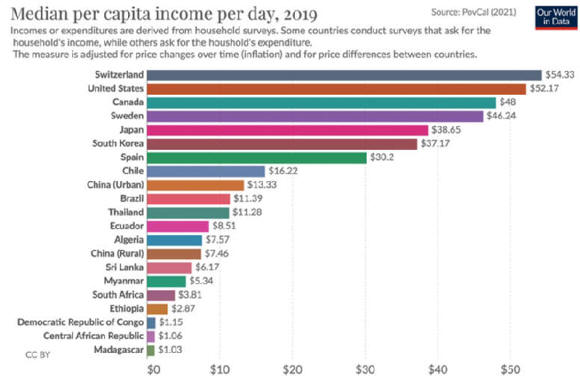

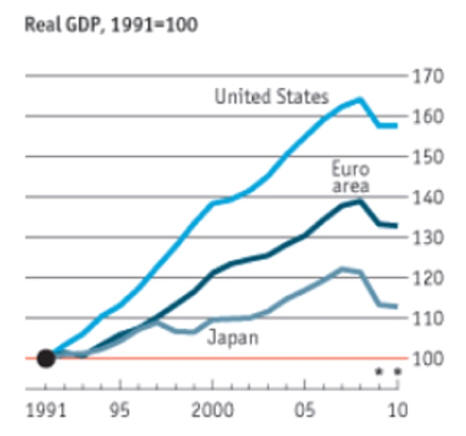

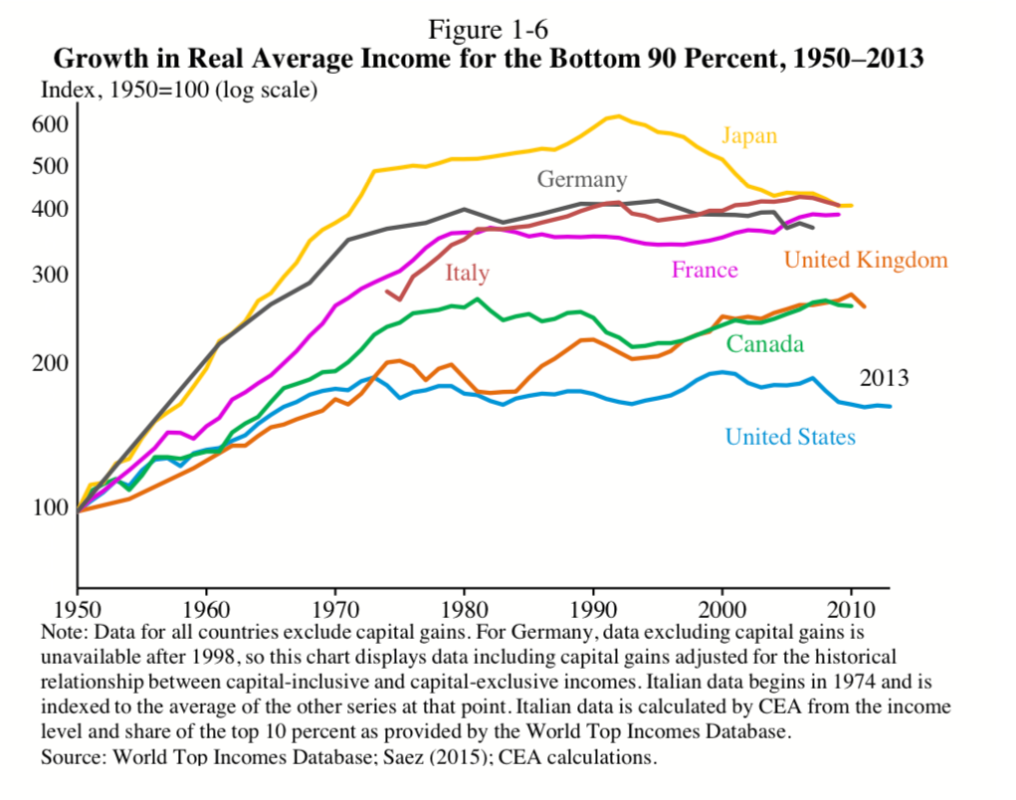

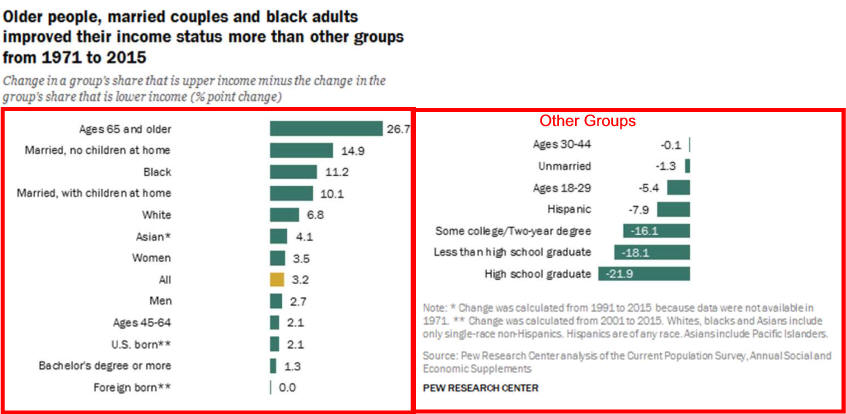

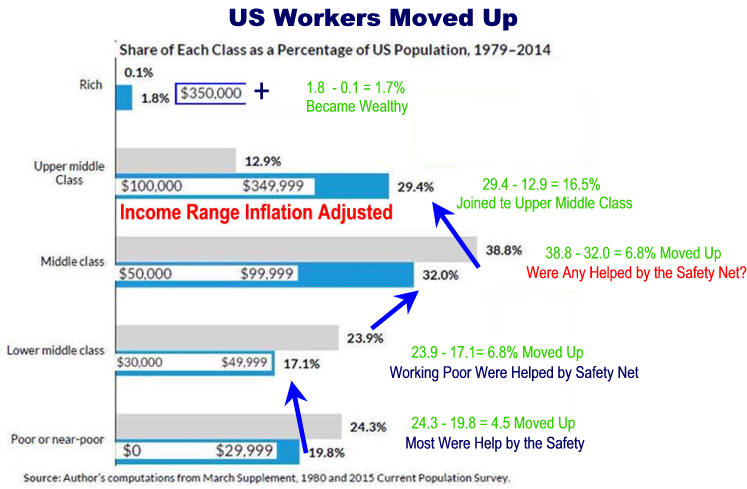

X.

Are Americans Better Off than they were a Decade or Two-Ago

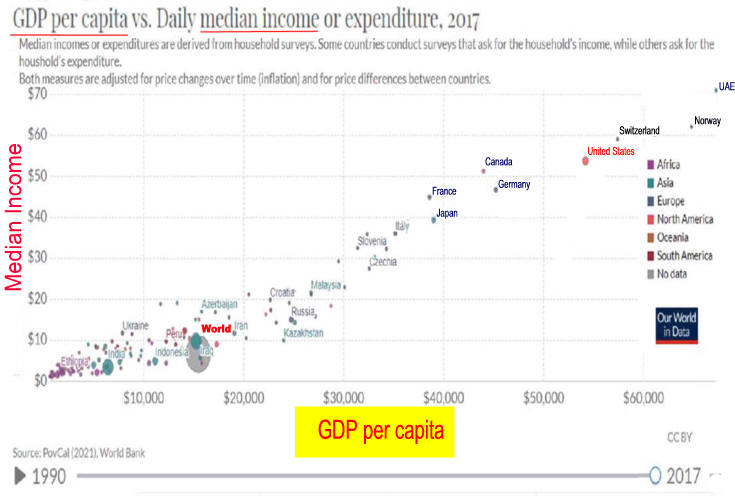

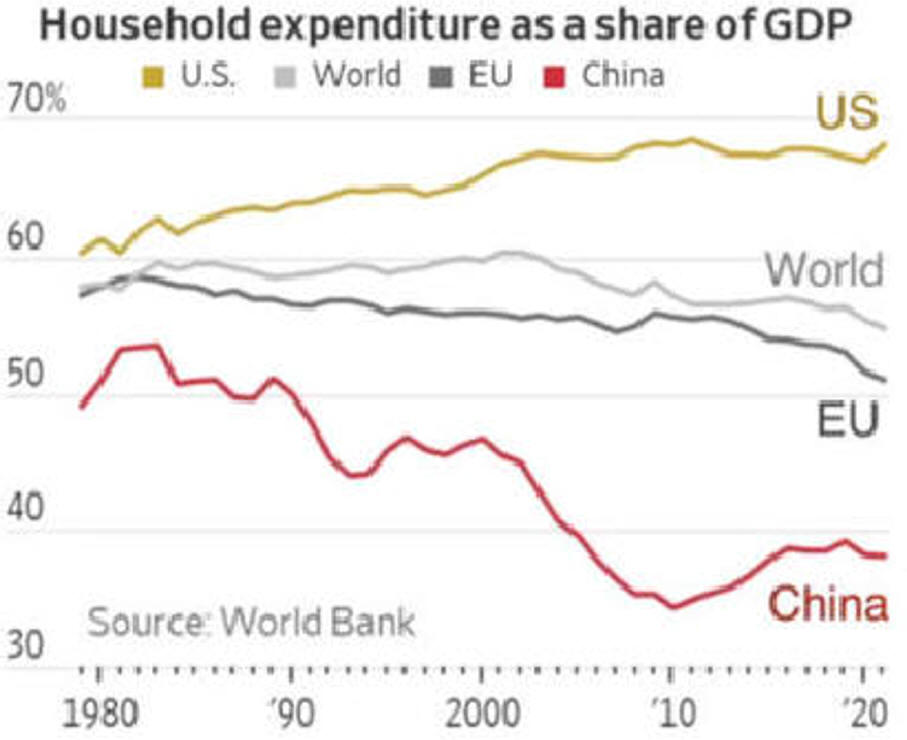

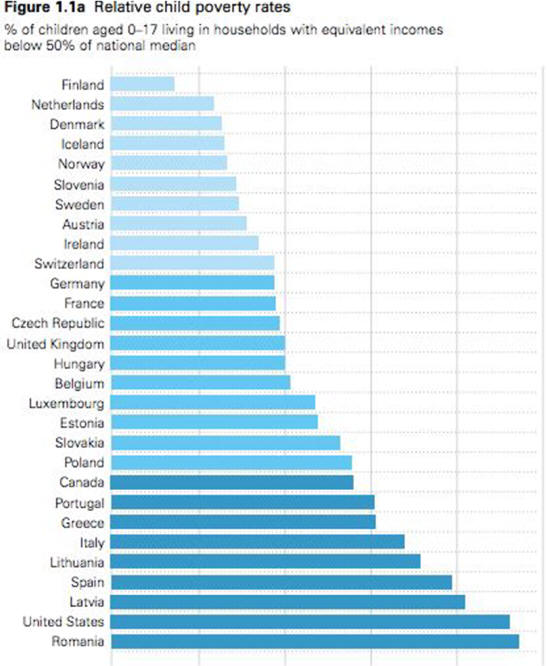

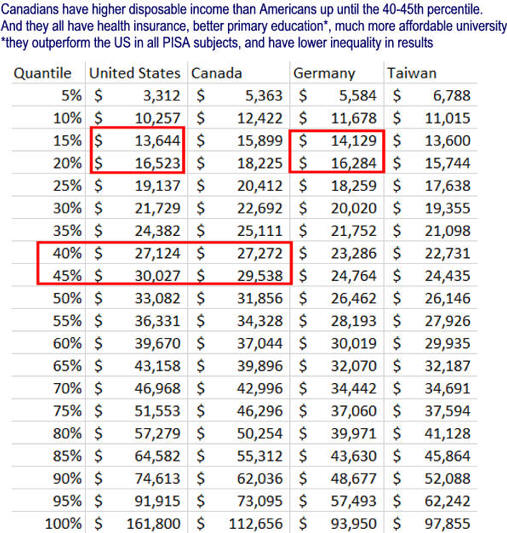

B. BernankeTable 1 confirms the conventional view that, broadly

measured, American living standards are comparable to those of the richest

Western European nations but much higher than living standards in

emerging-market economies. For example, this calculation puts economic

welfare in the United Kingdom at 97 percent of U.S. levels, but estimates

Mexican well-being at 22 percent. Interestingly, this comparison shows

Western European countries (like the U.K., France, and Italy) as

considerably closer to the U.S., in terms of economic welfare, than

differences in per capita income or consumption would suggest, reflecting

the fact that Western European countries do relatively well on the other

criteria considered (leisure, life expectancy, inequality). For emerging

and developing economies, however, differences in income or consumption

per person generally understate the advantage of the United

States, according to this measure, largely due to the greater levels of

inequality and lower life expectancies in those countries.

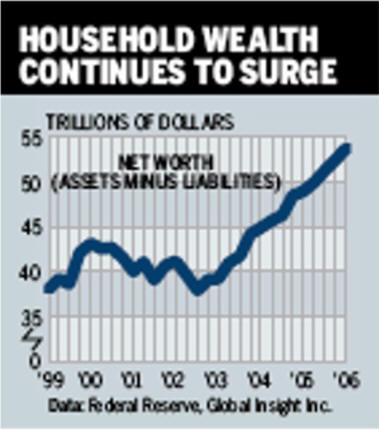

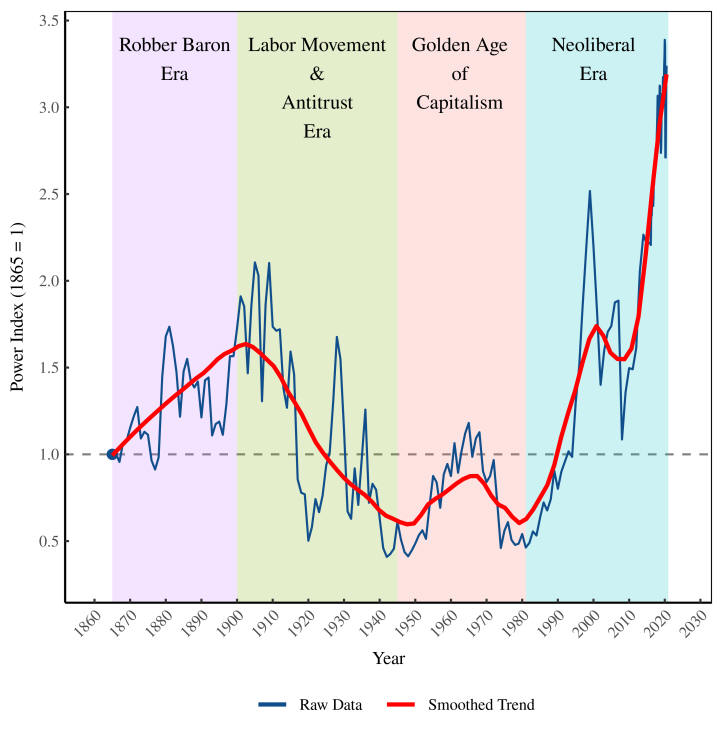

Table 2 shows that economic welfare improved at quite a rapid

pace over the two decades before the crisis (1995-2007), at more

than 3 percent per year, notably faster than the growth rate of per

capita GDP, at about 2 percent. [8]

As shown by the four rightmost columns of Table 2 and, graphically,

in Figure 1, the gains in welfare were driven primarily by increases

in per capita consumption and by improvements in life expectancy,

which rose by 2.3 years over the period, from 75.8 to 78.1 years.

Rising consumption inequality subtracted between 0.1 and 0.2

percentage points from the annualized growth rate in welfare during

the pre-crisis period, and changes in leisure/work hours per person

(which were stable) made only a very small contribution.

|

Cato Institute's 2018

Agrees

|

|

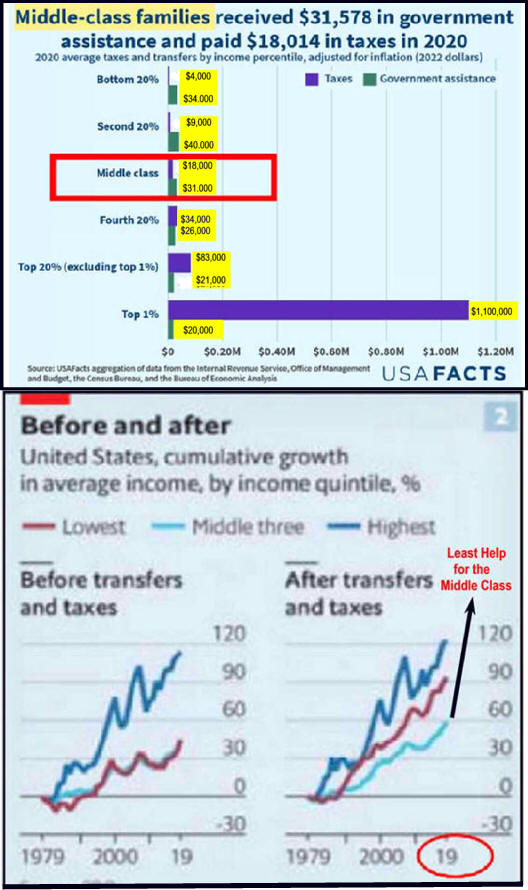

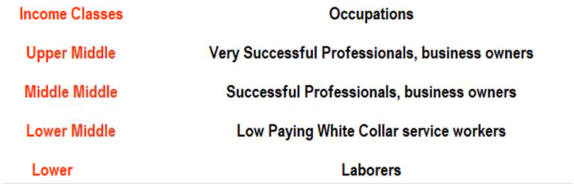

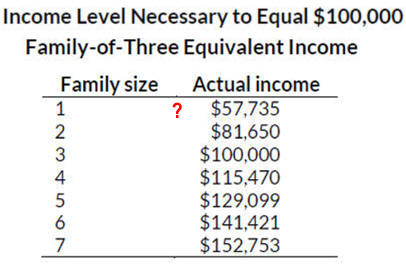

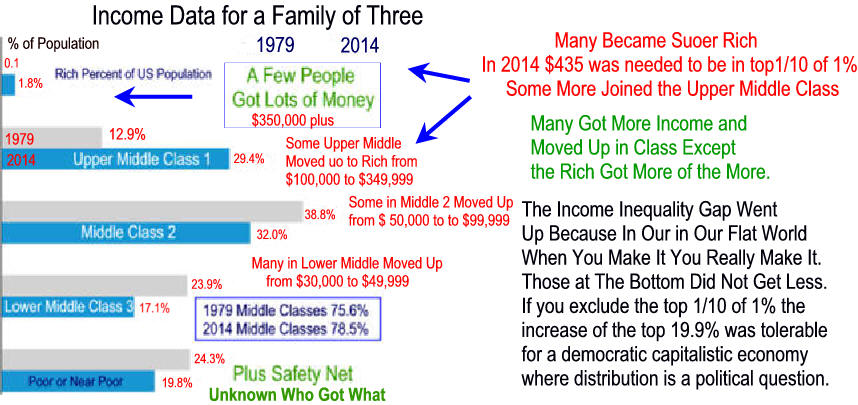

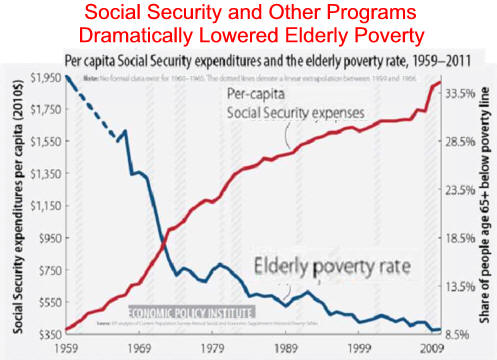

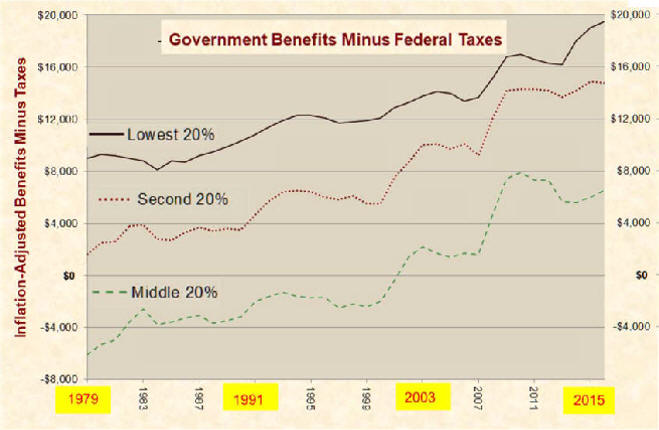

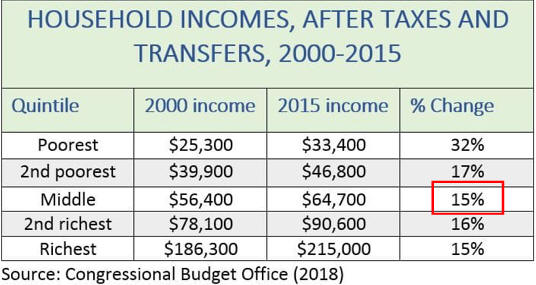

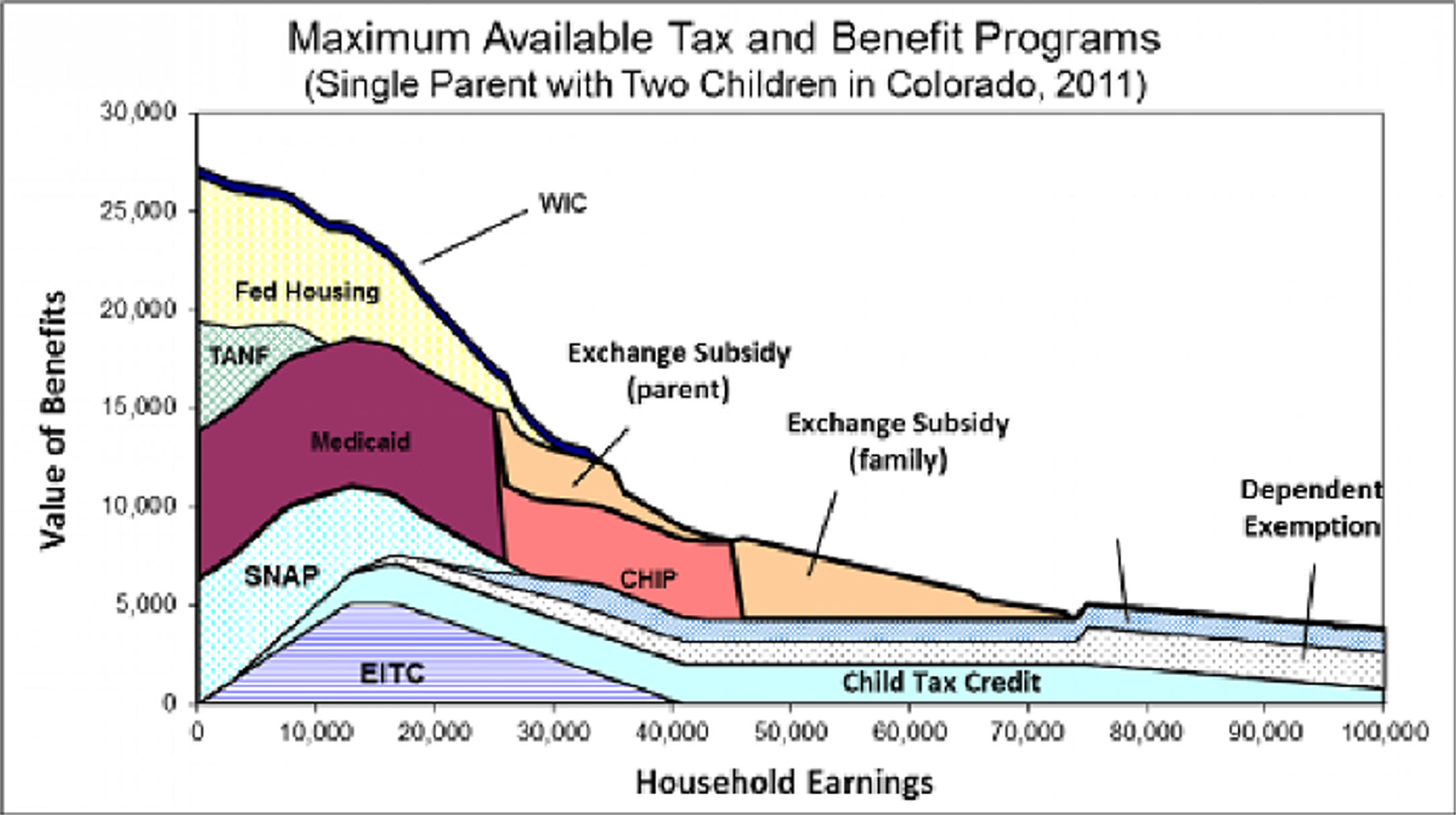

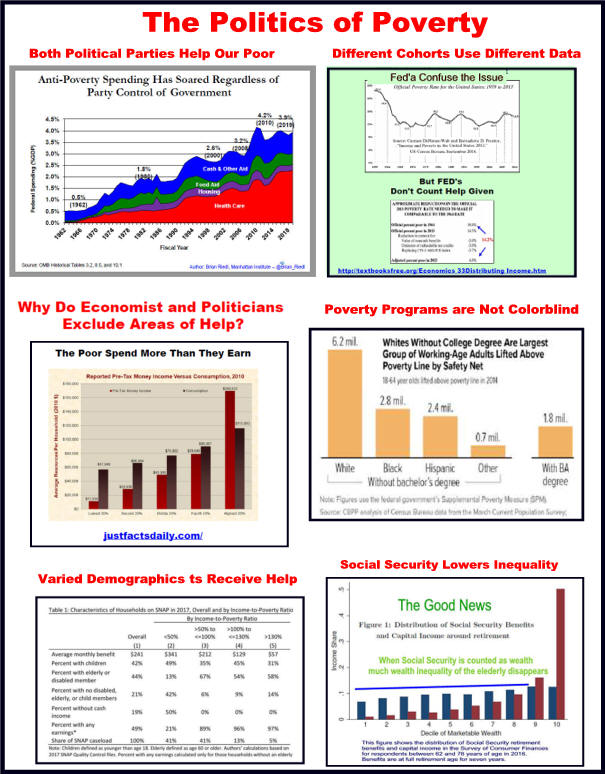

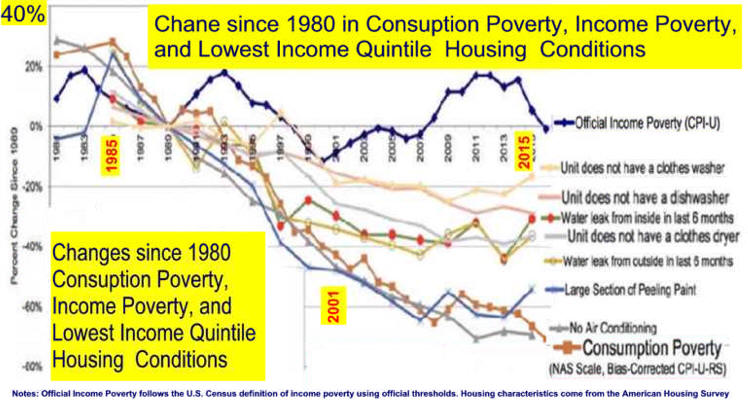

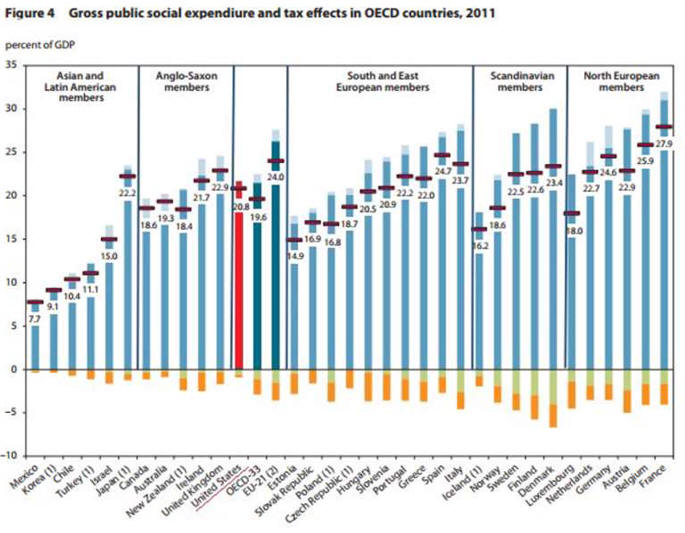

Reassessing the Facts Inequality, Poverty, and

Redistribution

Income Adjusted for

Governments

Bottom quintile earnings share

rose from 2.2% to 12.9%

Second quintile share rose from

7% 13.9%

Third

quintile middle-income quintile rose

from 12.6% to only 15.4%

Fourth quintile’s share

fell

from 20.5% to 18.6%

Top

quintile share fell from 57.7% to 39.3%.

Top to bottom multiple

dropped

from 26 times to three times

In addition work effort increased moving up the income ladder as

more family members worked and more worked two jobs.

Calculations

|

Author's

editorial! from when he started this project.

A September 3,

1992 Wall Street Journal editorial by Robert Rector,

a policy analyst

for the Heritage Foundation in Washington, D.C.,

reported the following concerning 1990 government spending on

poverty:

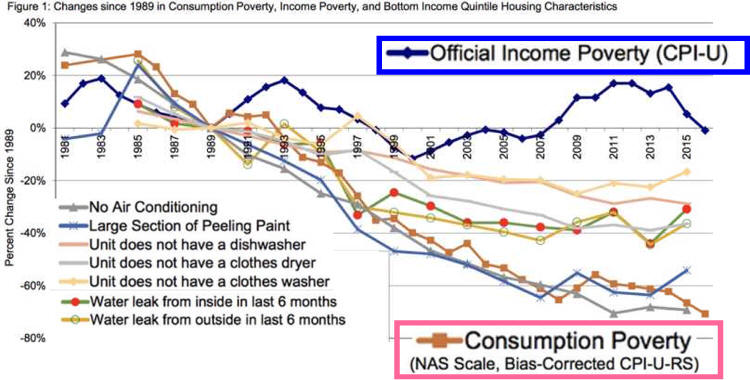

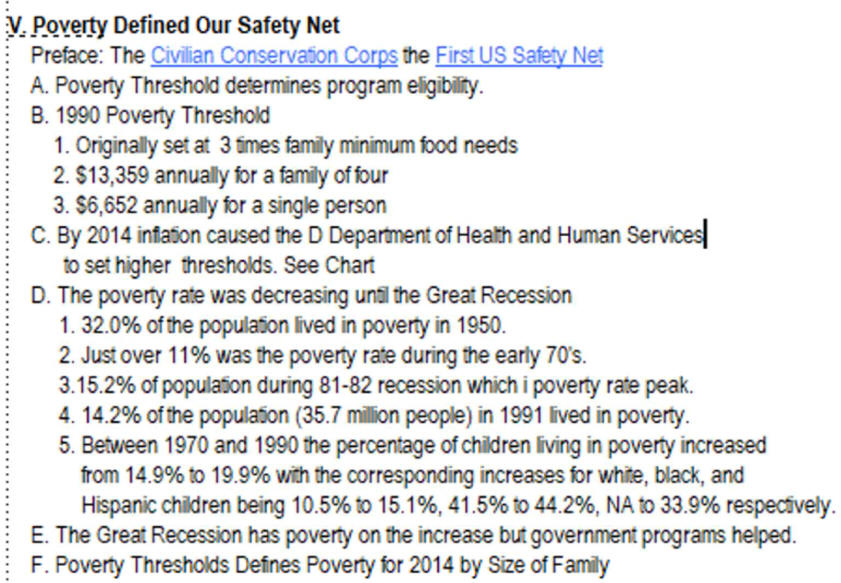

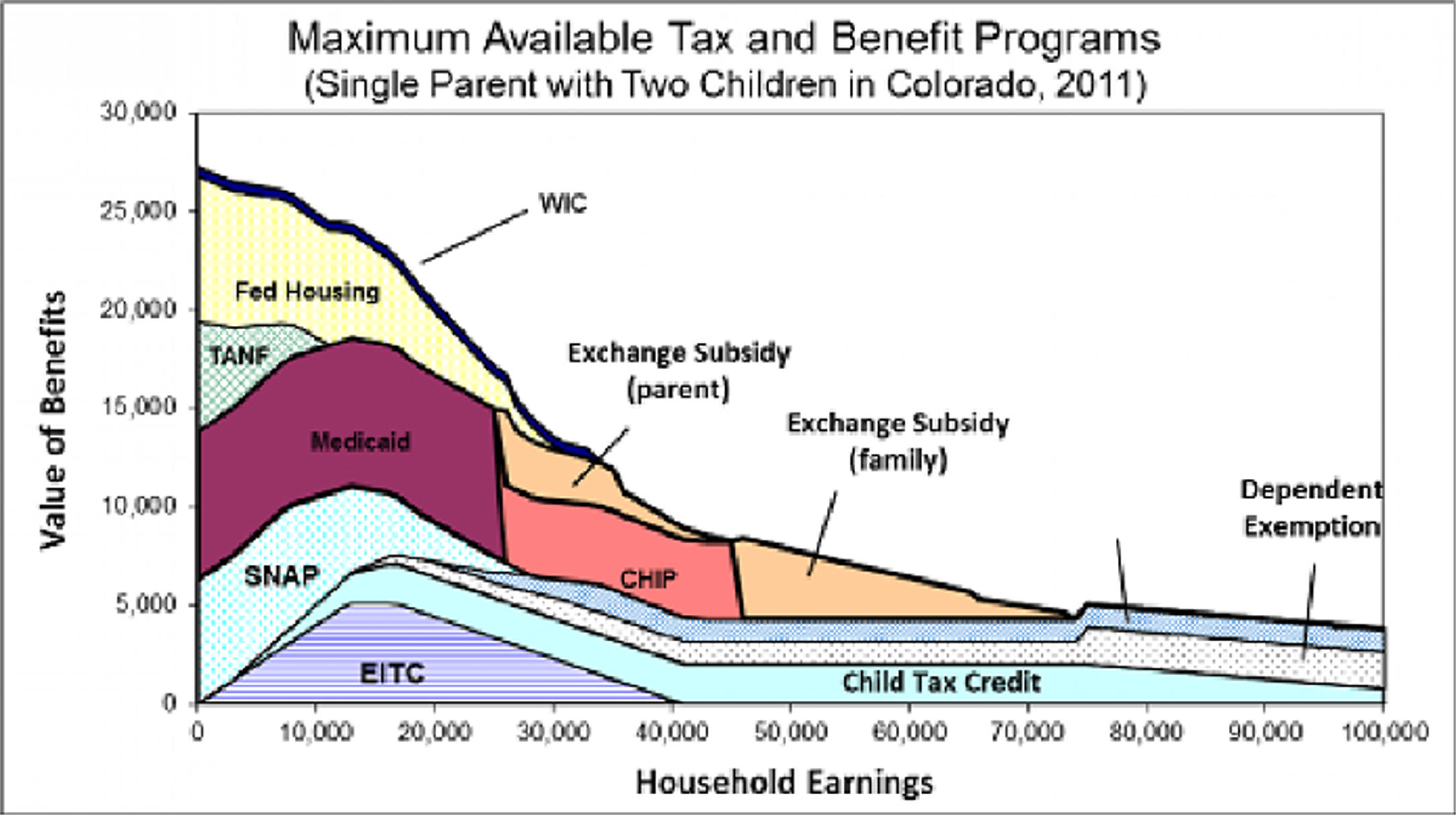

"Out of a total

of $184 billion in welfare spending..."

"...Census counted only $32.5 billion as income."

This means that the actual income of those living in poverty is substantially

understated.

It is difficult to lower the number of

people living on poverty income

if much of the money given them

does not count as income!

Editors Note: In

2015 people still see the poverty percent and assume x percent

are starving when most are receiving food stamps, subsidized lunches ...

Approximate per capita understatement

would be calculated as follows:

Administrative costs must be subtracted therefore not all of

the $4,328.57

per person was not given in direct aid.

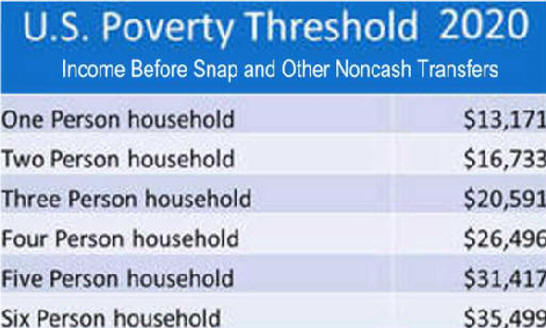

Editor's Note: It has been 25 years since

this analysis and still in 2017 most people do not realize

that the U.S. Government publish poverty rate is before noncash

transfers like SNAP (food stamps).

One Columnist used the rate during the Great Recession to report 50

million mostly children were starving.

"Stupid is as stupid does."

|