|

V.

Should the

Federal Debt be Paid

Prelude:

National Debt

Basics Video 15 min

A. Pay it

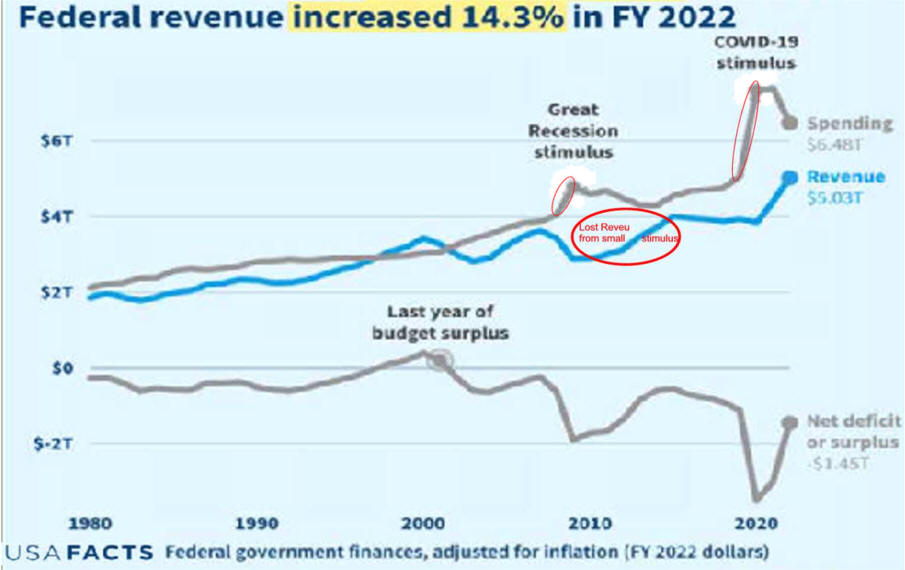

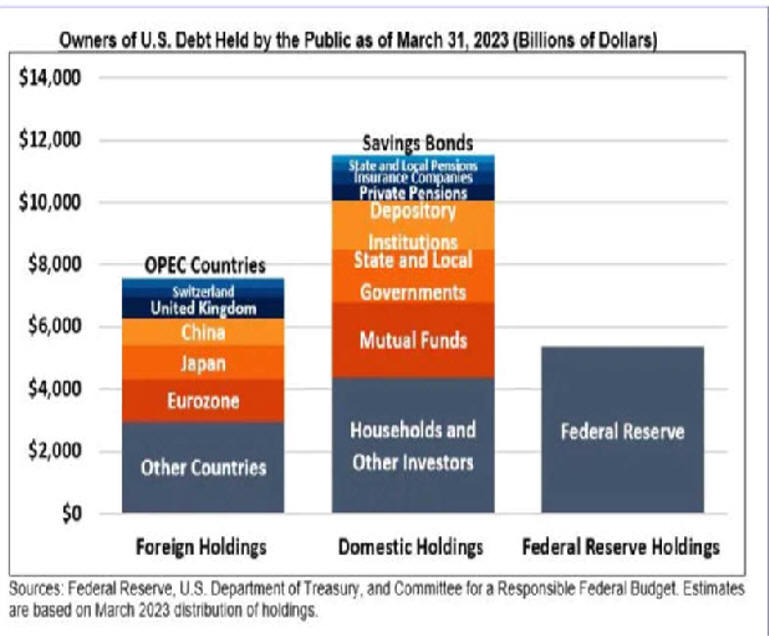

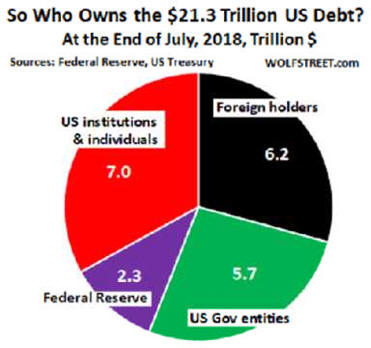

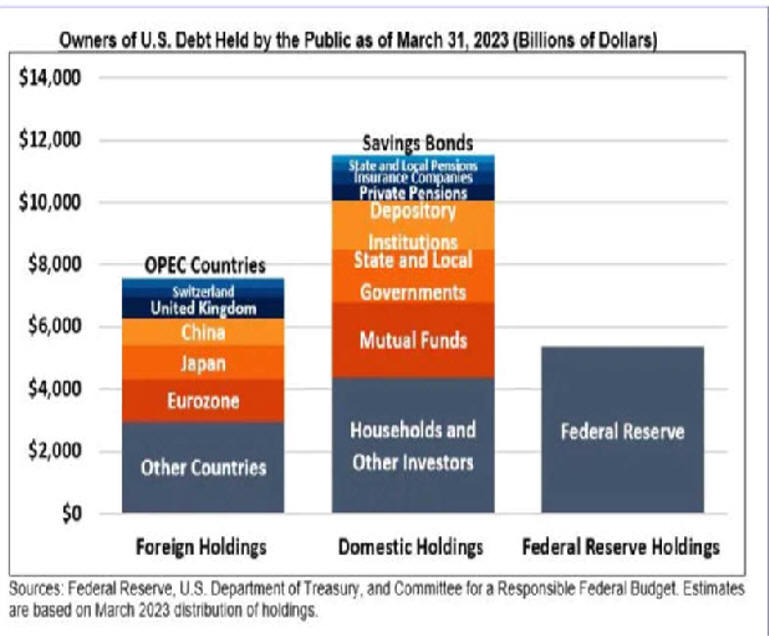

1. The external

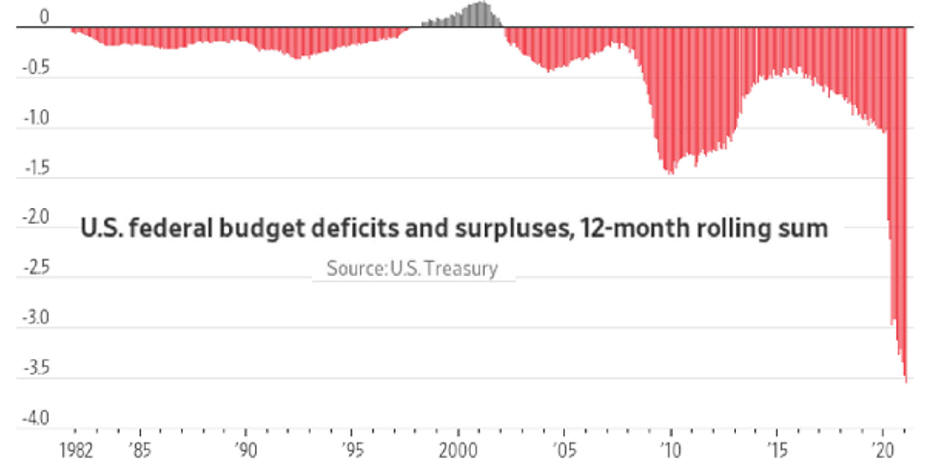

debt (owned by foreigners) has gone up from

5% in 1960 to 13% in 1988, 22% in 1999 and 43% in 2005.

2. The

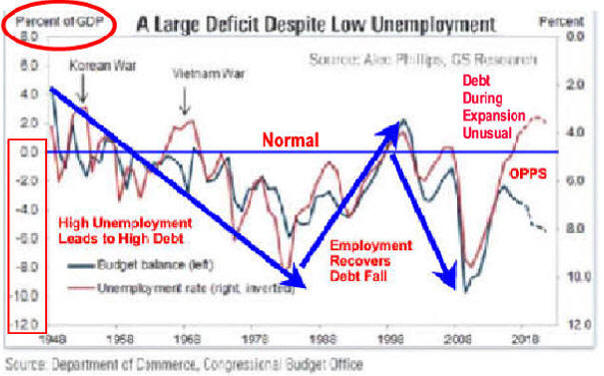

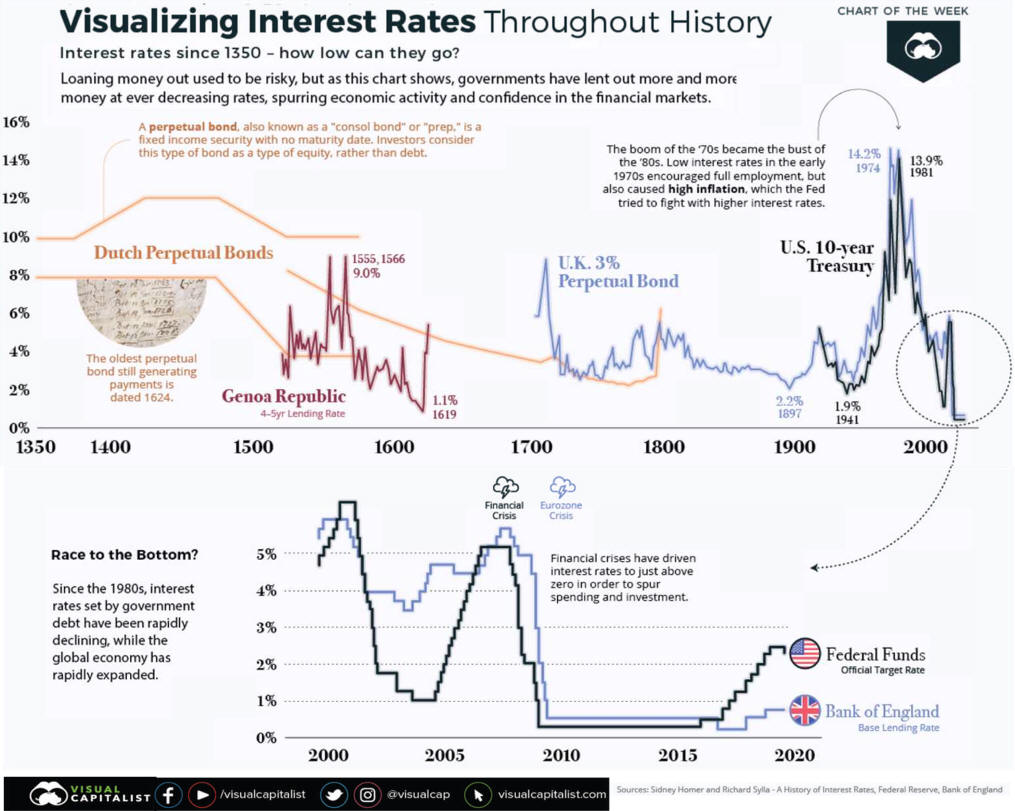

crowding-out effect slows growth as Federal dissaving

causes

high interest rates lowering private investment.

3. Paying $230

billion in annual interest causes incentive problems

as this money

could be used

to solve many problems.

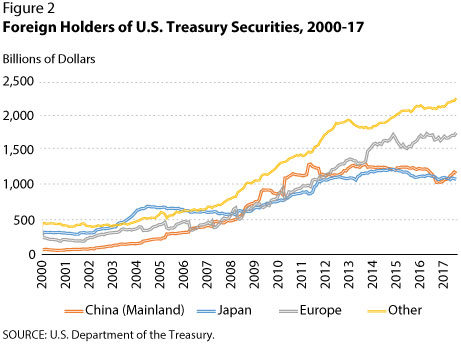

4. Recently

foreigners have been willing to invest their export earnings in America

helping

to minimize the effect of the high federal deficits on interest rates.

a. If

foreigners decided not to make these investments, interest

rates would increase, slowing economic growth.

b.

Interestingly one of the reasons the Federal Reserve

was unable to lower long

interest rates quickly during the 1990-91 recession and its recovery may have

been

the Japanese decision to dramatically curtail their U.S. investments.

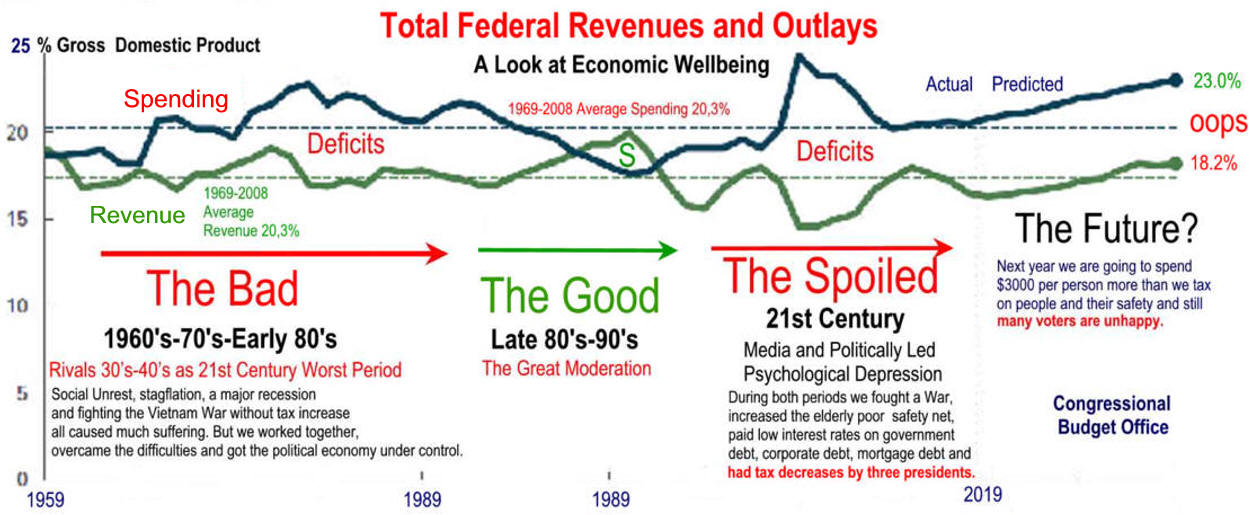

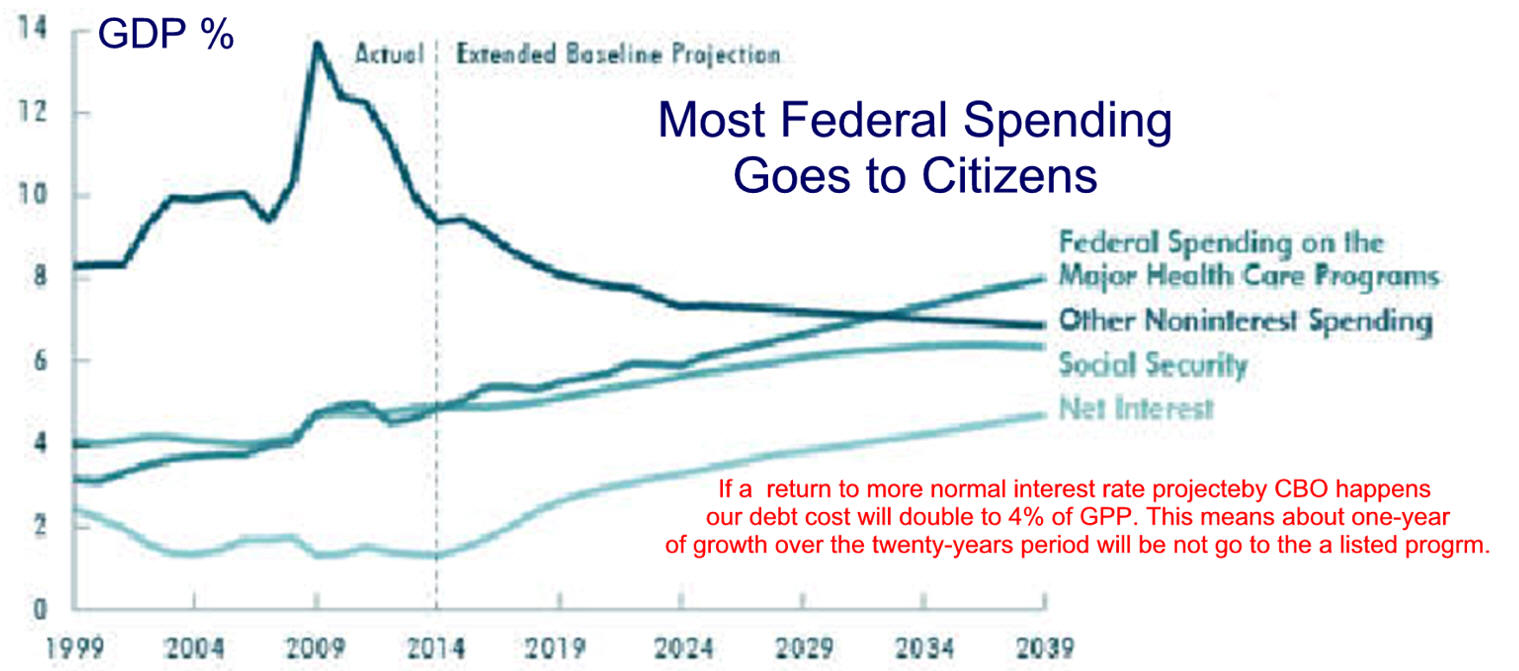

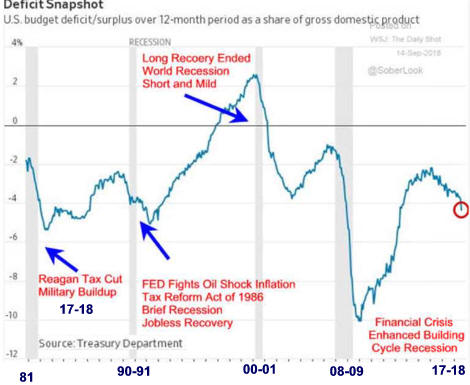

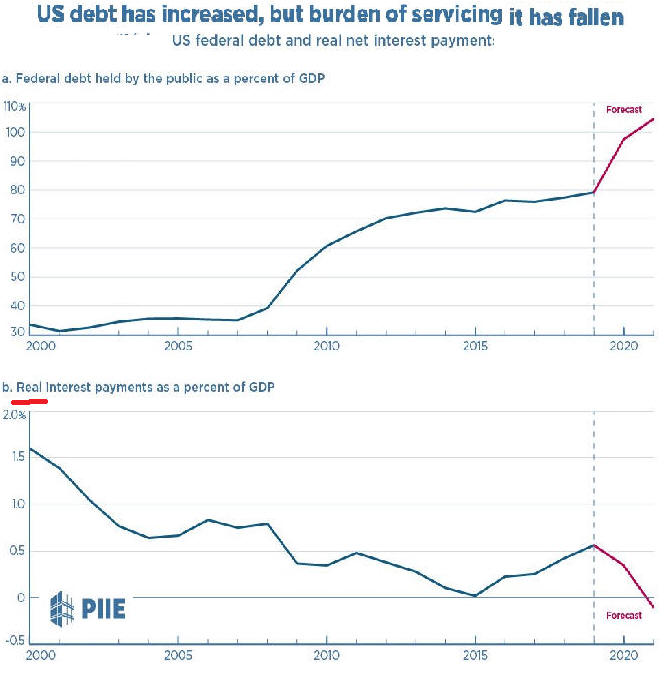

5. Annual interest on the federal

debt increased 50% (from

1.9% to 3.3%) during the 1980's. By 1999 it was down to 2.5%.

6.

How To Tell

Debt Facts From Political Hype

7.

Good Is Bad Up Is Down

B. Don't Pay It

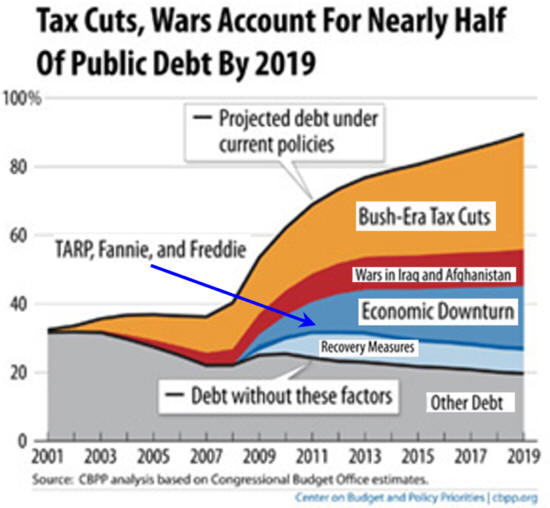

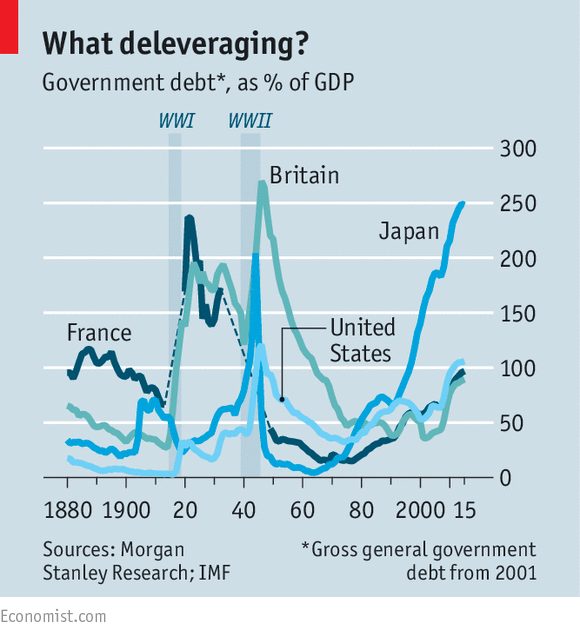

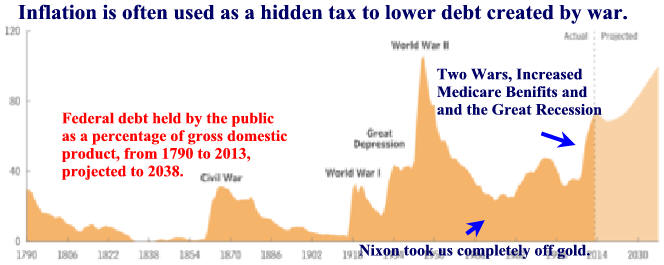

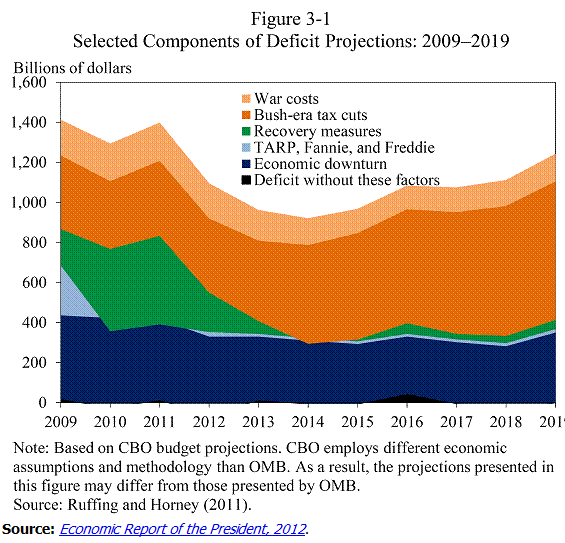

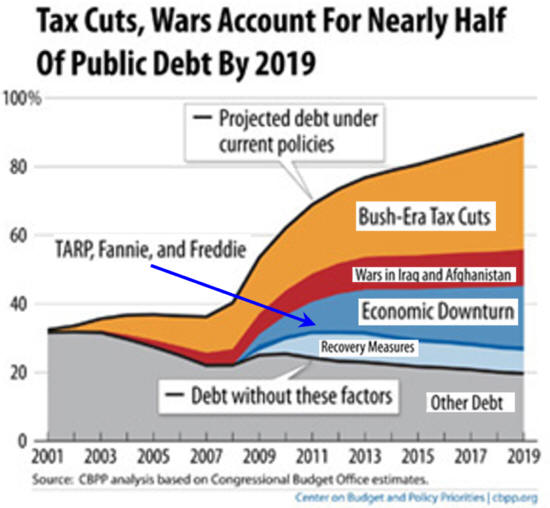

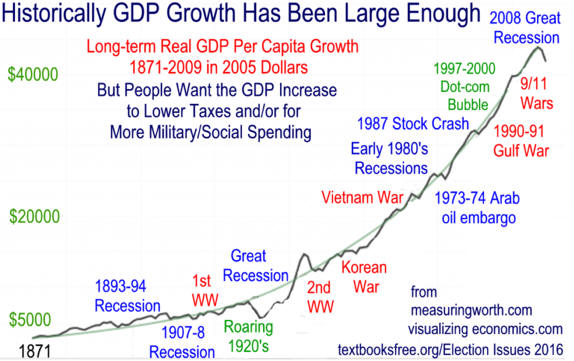

1. The debt was caused by wars and recessions.

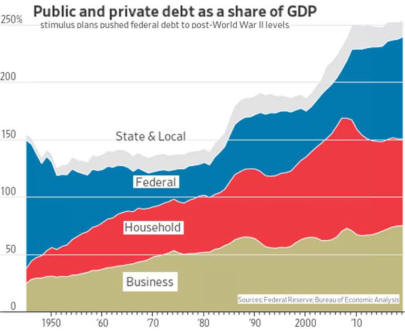

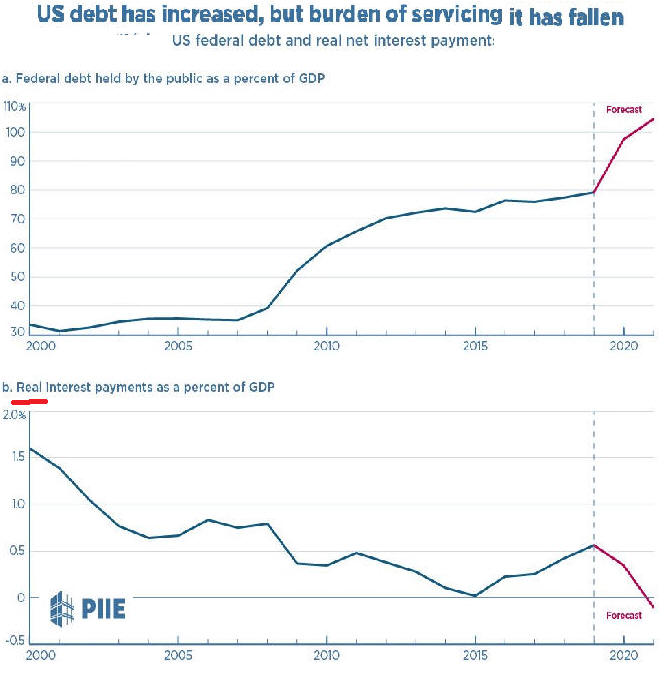

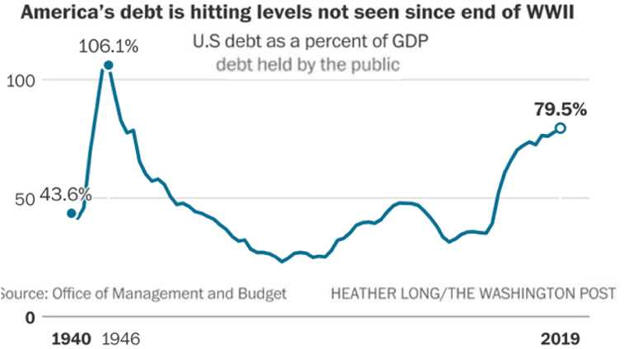

2. We are not going

bankrupt, the debt is about 100 % of

one year's GDP.

a.

First-time homeowners go a few salary

years into debt.

b.

Much of the annual deficit goes into

capital expenditures and because the

U.S.

does not have a capital budget, these items are all expensed in

the year

of purchase.

During periods of growth, the result is

an over statement

of the

deficit.

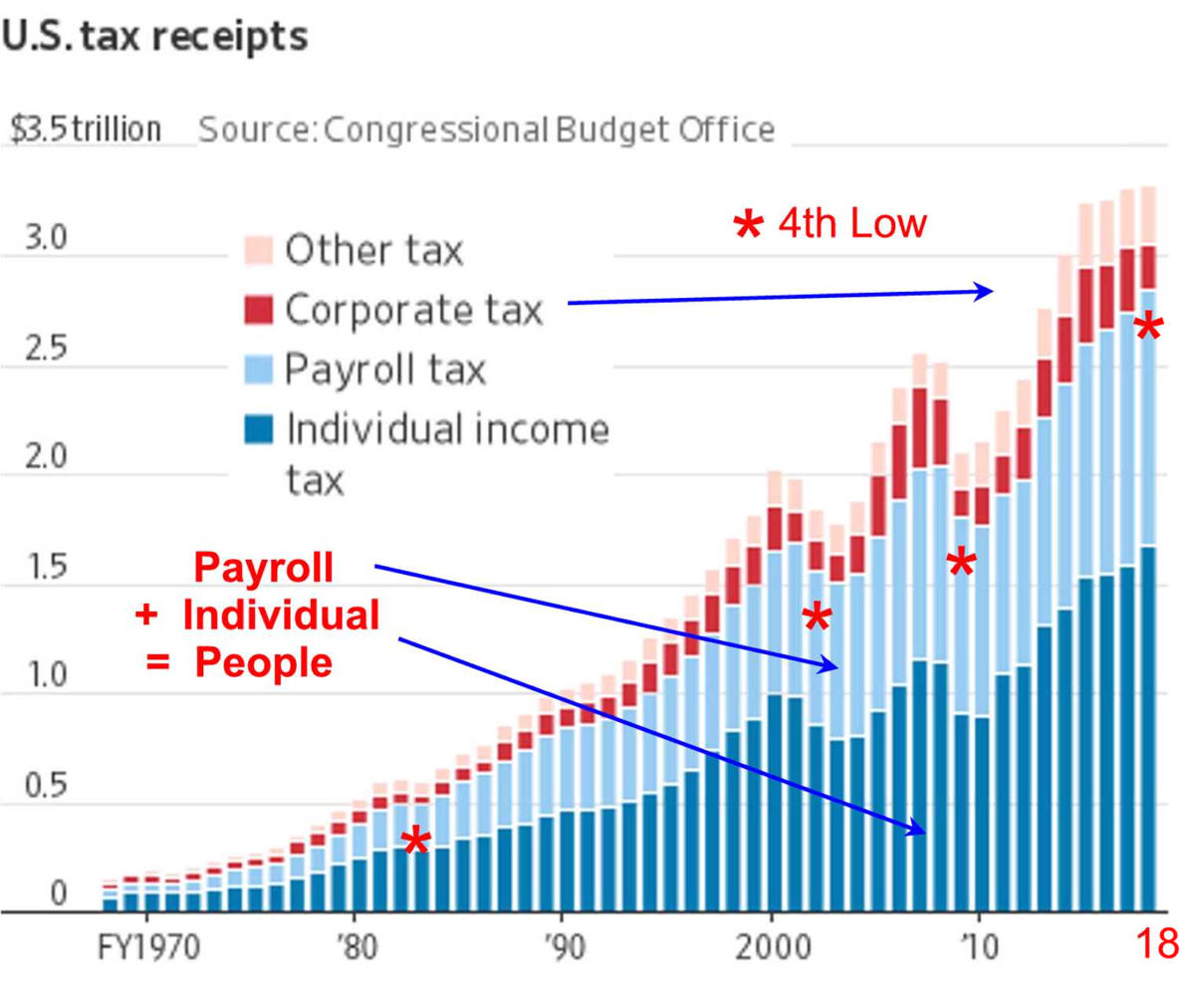

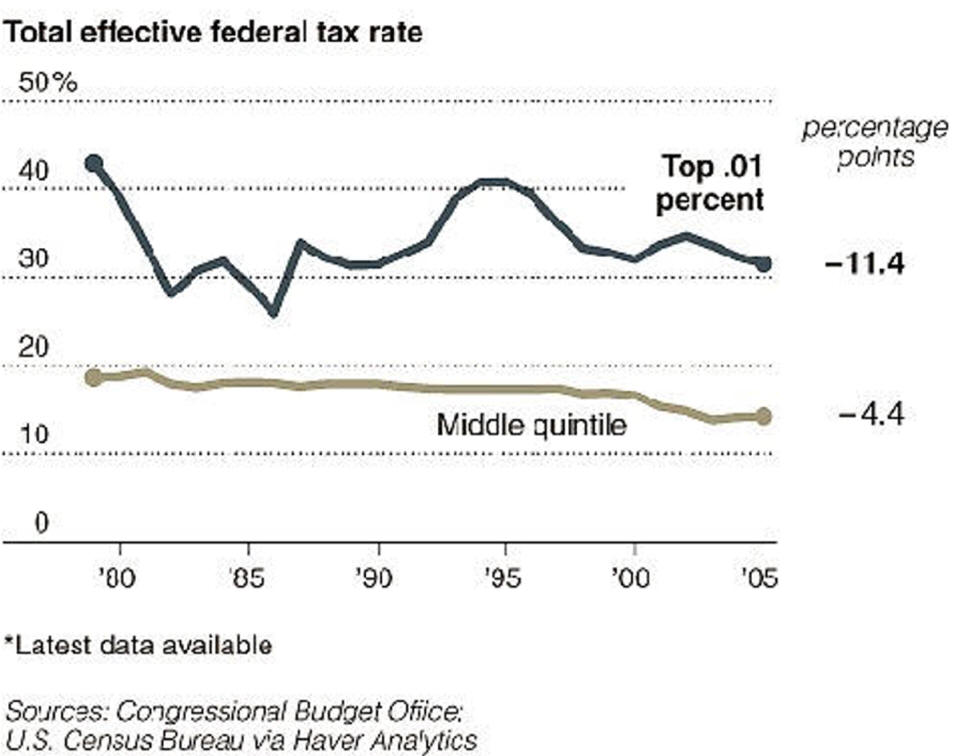

3. Paying it would overtax

the average American.

4. Most Americans would

rather spend tax

money to solve problems

rather than

lower the deficit.

a. This attitude changed

substantially in the

early

1990's.

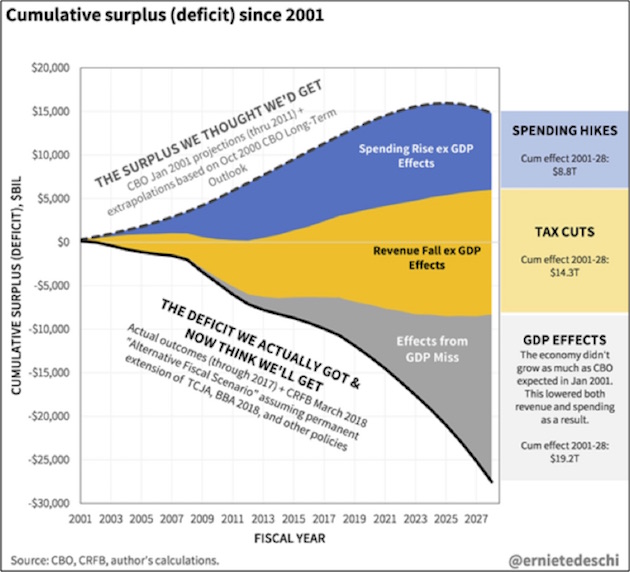

b. By the end of the

1990's, projection had

the debt paid off in 10 years.

By 11/01

the

impending recession and events of

September 11

cast a shadow

on this 10-year projection

4.

What

is the Federal Debt: a primer for politicians

5.

The Big Lie

6.

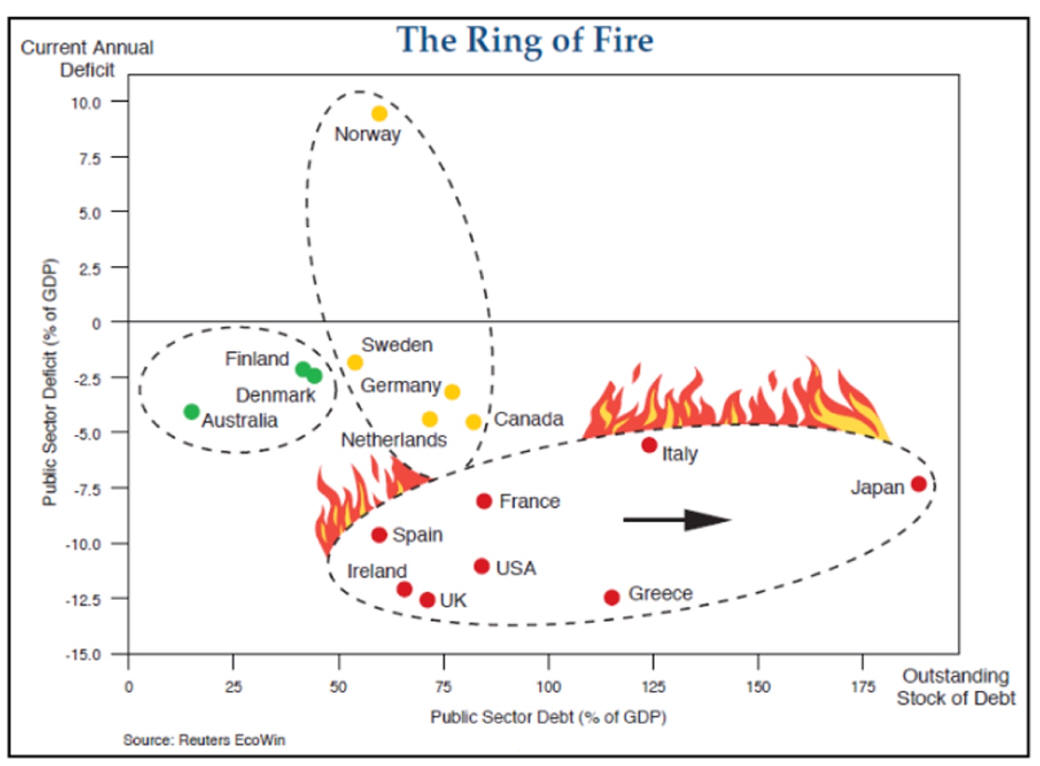

2 Concerns: U. S. Governments Debt

7.

Deflating National Debt Through Inflation

5 min video

8.

Ray-of-hope-about-the-federal-deficit/

C.

Balance the budget is a simulation that

allows

participants to make changes and balance the budget.

D.

Modern Money & Public Purpose 1 hour

plus

1, The Historical Evolution of Money and Debt

2. Governments Are Not Households

3: The Eurozone

4: Real vs. Nominal Economy

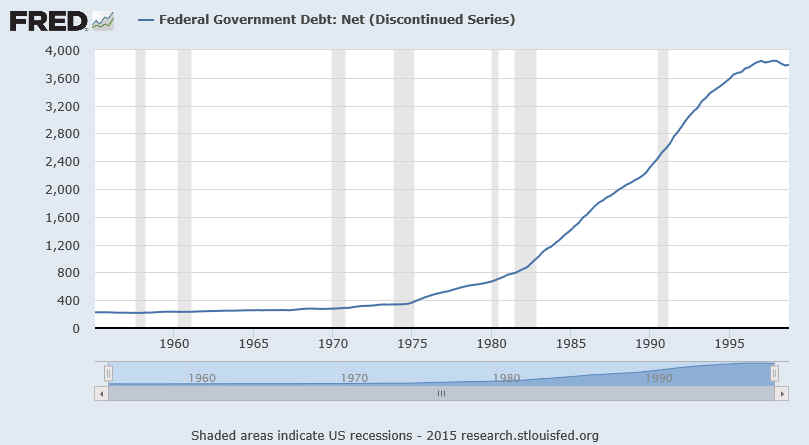

|

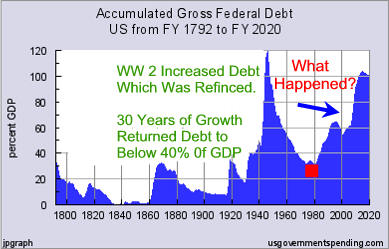

Who Has Paid For the

Federal Debt?

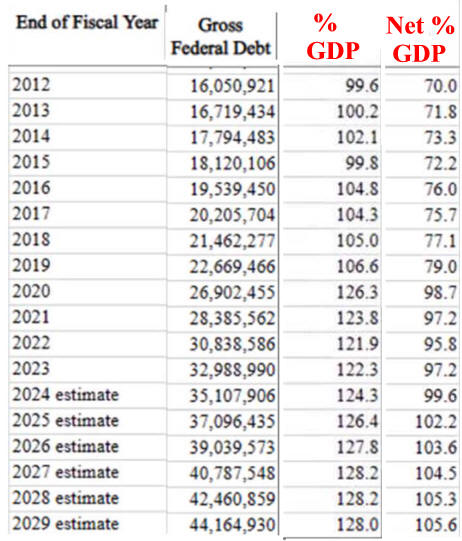

End of

Fiscal Year |

US Gross Debt

in Nominal USD billions |

US Gross Debt

as % of GDP |

Who Paid |

| 1940 |

43.0 |

52.4 |

No

One |

| 1950 |

257.4 |

94.1 |

| 1960 |

290.2 |

56.1 |

| 1970 |

389.2 |

37.6 |

| 1980 |

930.2 |

33.3 |

No

One |

| 1990 |

3,233 |

55.9 |

| 2000 |

5,674 |

58 |

TBD |

| 2005 |

7,933 |

64.6 |

| 2007 |

9,008 |

65.5 |

| 2008 |

10,699.8 |

74.6

(EST) |

|

2009 |

11,046.2 |

|

TBD |

|

United

States public debt - Wikipedia, the free encyclopedia |

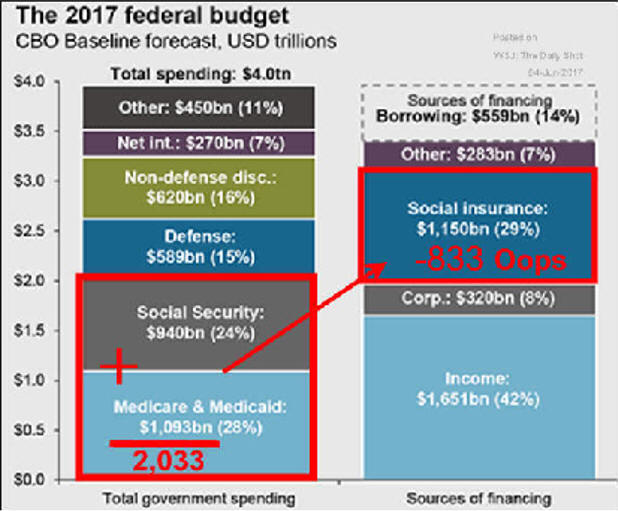

What if the Federal Budget Was $100

Navigating Big Debt Crises

Mark Blyth Videos

Devastates Approach to Budget

Liberal View of Balanced

Budgets

Interest Payment Management Approach

Please link to and Share!

10/2/22

See

Quick Economics

Notes

|

|

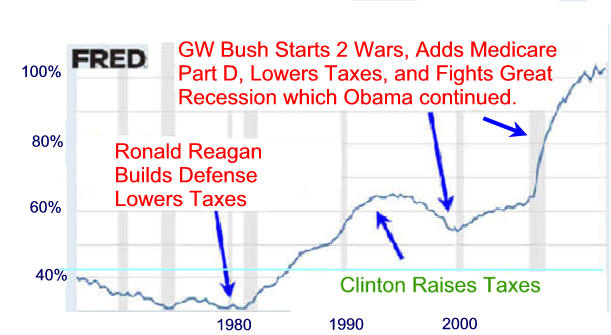

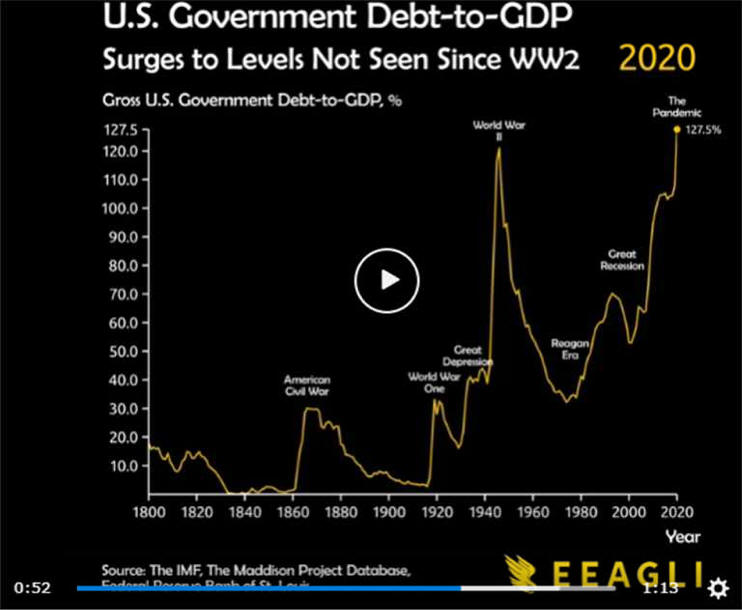

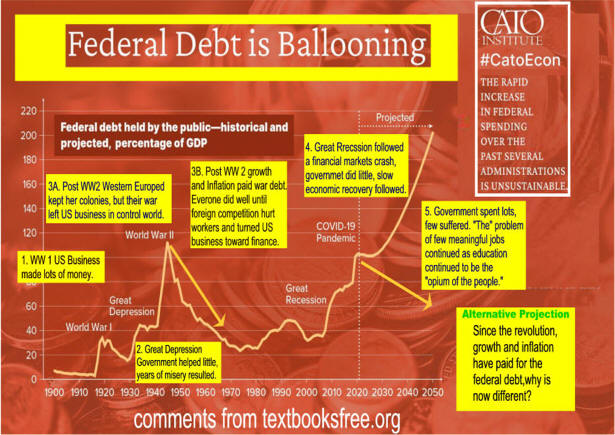

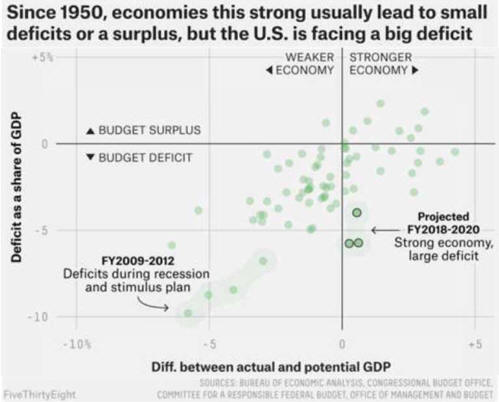

Editor's Note:

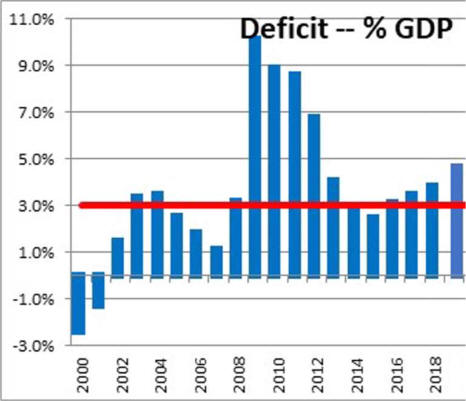

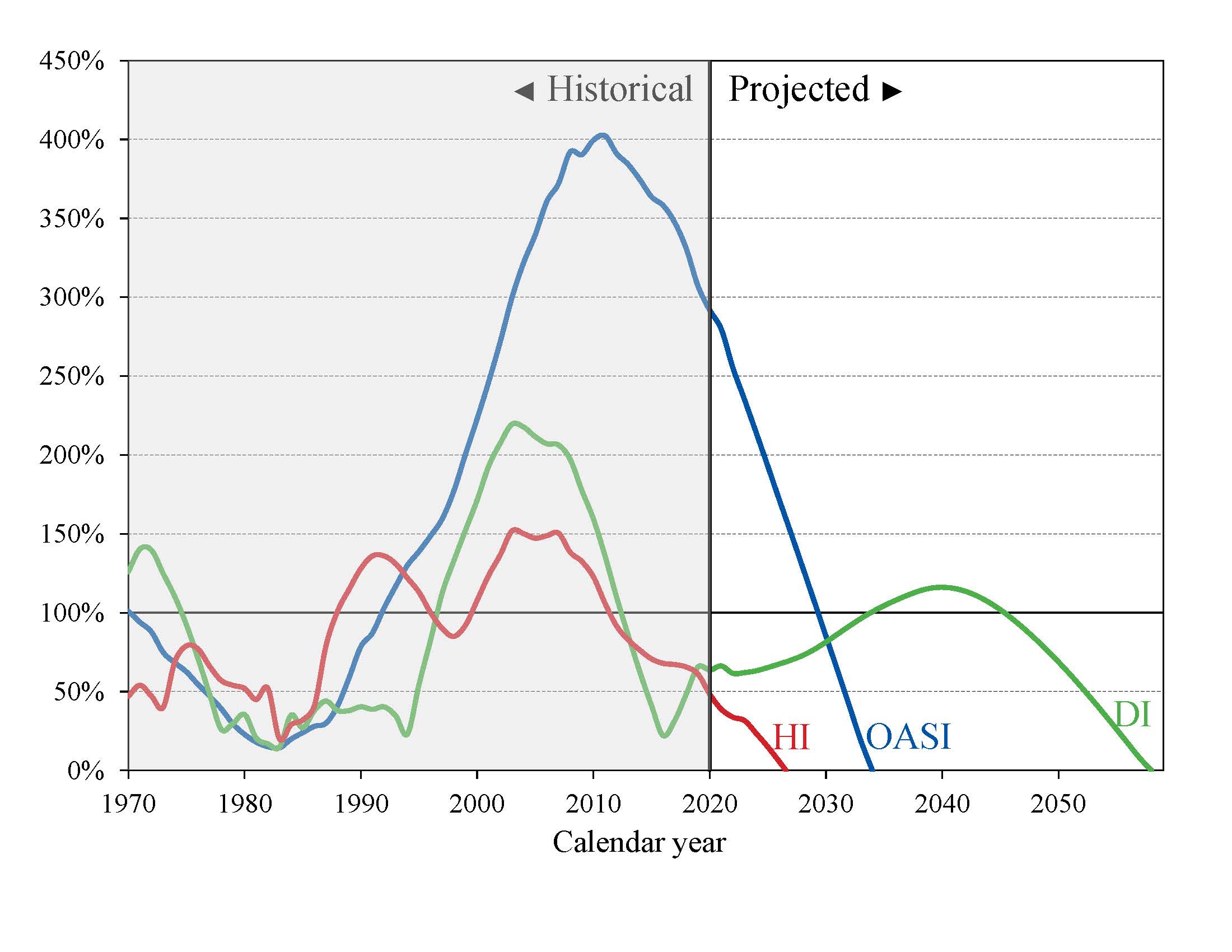

The Debt to GDP

ration headed up

with Ronald Reagan, dropped with

Clinton, then headed up again with

Bush 2 and finally leveled off killing Obama's second term projections could force reductions

in entitlements unless the economy really takes off.

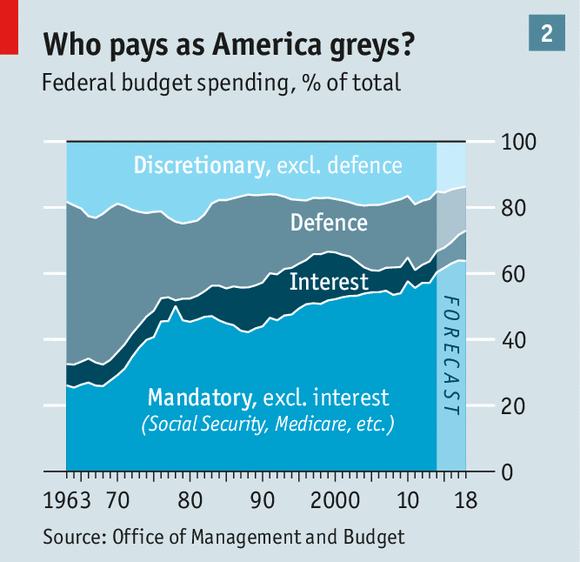

The effect of Obamacare are not known. Entitlements

are not contracts. What

congress gives it can

take away.

|