Index

II. Aggregate Demand and Equilibrium

|

|

Index II. Aggregate Demand and Equilibrium |

|

|

1. Average Propensity to Consume (APC) is consumption (C) divided by income (Y). a. APC = C/Y b. APC decreases as income increases as people can afford to save. 2. Marginal Propensity to Consume (MPC) is the change in consumption divided by the change in income. a. MPC decreases as income increases. b. This makes sense because when an average is falling, what is happening on the margin must be less. 1) If a test average drops, it was pulled down by a lower number. 2)

3. Saving (S) is income minus

consumption. S = Y - C

5. Marginal

Propensity to Save is change in saving divided by change

in income.

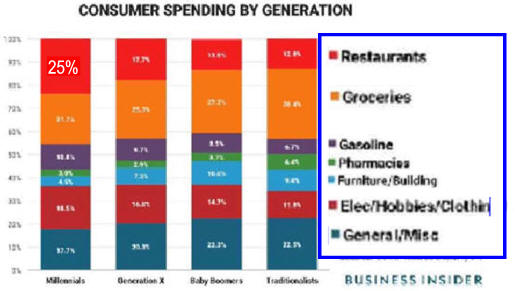

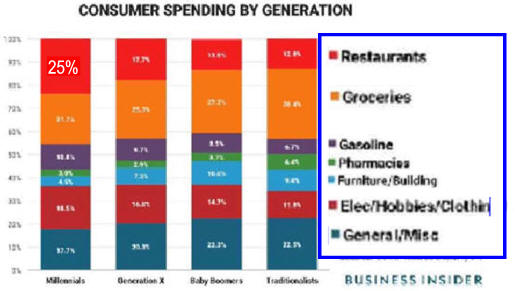

expectations about personal needs and future economic activity, and concerns about consumer, business, and government debt. B. Investment is business

spending on capital goods, inventory, and C. Government Spending is assumed to be constant. D. Net Exports equal exports minus

imports, are also assumed to be constant F. The Diminishing Contribution of Federal Spending to GDP

One problem with this simplified assumption is it assumes investment

is

fixed.

|

Low Investment Advantage US as I moves toward US.

|

|

|

|

|

|

|

|

|

|

|

|

Keynes Requires an Extraordinary Workout

|

|

II. Aggregate Demand and Equilibrium

A. Equilibrium (E) is where planned and actual AD and AS are equal. 1. Equilibrium is where all goods produced for sale are sold. 2. At points below equilibrium, AD < AS, inventories are building and business activity is contracting. This level of economic activity was depicted by the horizontal (Keynesian) range of AS explained in the previous model. 3. At points above equilibrium AD > AS, inventories are decreasing and business activity is expanding as depicted by the intermediate range and eventually the classical range of AS. 4. Economic activity (Real GDP) will be wherever AD intersects AS. Equilibrium seldom exists as economic activity is usually in one stage or another of the business cycle. B. If economic activity is not in balance, a dynamic situation exists and will continue until equilibrium is reached. C. Keynes believed that E could settle at a level of economic activity with large amounts of unemployment. 1. If potential Real GDP is greater than what actual AD yields, a reces- sionary gap exists and may persist indefinitely. The solution to this unacceptable equilibrium is to increase AD. 2. If potential Real GDP is less than what actual AD yields, an inflationary gap exists and the inflation may persist indefinitely. The solution to this unacceptable level of economic activity is to decrease AD. 3. Inflationary and Recessionary Gaps- ACDC Economics in 60 Seconds D. Multiplier Affect (K) is important to determining the change in AD needed to reach equilibrium E. 1. Changes in AD will result in larger changes in NNP as increases are not spent and respent. 2. Decreases in AD have a similar but opposite affect. 3. K = 1/MPS = 1?(1-MPC) Note: As MPS increases, K decreases. 4. A MPS is 20%, Multiplier is 5 as 1/20% = 1/(1/5) = 1X 5 = 5 5. Fiscal policy and the multiplier... is an 9 minute video from YouTube

III. Fine Tuning Economic Activity

IV. Multiplier US Government Spending About 10% Lower Than Western Europe.

V. Additional Material

|

|